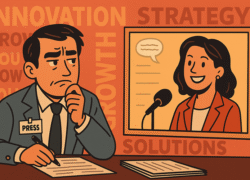

Once upon a time in Central and Eastern Europe, a journalist sat down to interview a woman in real estate. The goal was simple: capture her real story—struggles, triumphs, the occasional ugly-cry in the office bathroom. You know, the human stuff.

But then the answers went through the Great Corporate PR Blender™. Out came not a voice, but a smoothie of “synergy,” “innovation,” and “forward-looking solutions.” Deliciously bland, with all the lumps of personality removed.

Suddenly, instead of “I messed up but learned from it,” the quote became “Our organization values resilience as part of its strategic vision.” Instead of “Sometimes I doubt myself,” it was “We leverage opportunities to foster inclusive growth.” And instead of “I like tennis,” it was “Sports and recreation embody our core commitment to sustainability.”

The journalist, blinking through the corporate fog, made a daring suggestion: “Maybe we could add a few real-life details? Let her sound… human?”

The company’s response: a polite email equivalent of slamming the door. Better silence than spontaneity.

And that, ladies and gentlemen, is how we keep getting real estate “profiles” that read like IKEA manuals: technically correct, but guaranteed to put you to sleep.

This might be forgivable if it were about quarterly profits. But no—these were stories meant to inspire real estate readers. Imagine how much more powerful it would be if executives admitted: Yes, I felt intimidated. Yes, I got interrupted. Yes, I once wore two different shoes to a board meeting because last night was chaos. That’s the stuff that makes you go: Finally, someone gets it.

Instead, they’re handed paragraphs polished smoother than a wax museum statue. Authenticity? Missing. Relatability? Deleted. What remains is corporate kabuki theater, performed in the dialect of Buzzwordish.

The irony is rich: in trying to look strong, brands end up looking robotic. In trying to “control the message,” they lose the very thing audiences crave—the messiness of real human stories.

So, if the goal is truly to inspire future real estate executives, companies might want to try a radical strategy: let people talk like people. Imperfection won’t kill your brand. In fact, it might just make it loved.

Until then, every journalist in the region knows the drill: prepare your questions, hit record, and then watch as marketing departments translate blood, sweat, and tears into… “strategic alignment.”

Author: Mitzilinka (Turning grim reality into comic relief—without losing the truth)