New figures from the EU’s statistical office show that in 2024, the average age at which young people left their parents’ homes was just over 26 years. The pattern varies widely between countries: in the Nordic states, most young adults are independent by their early twenties, while in parts of southern and eastern Europe many remain at home until around thirty.

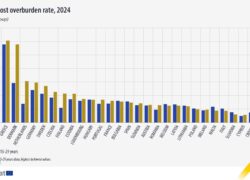

The data also point to a growing financial strain. Almost one in ten people aged 15 to 29 now live in households that must dedicate at least two-fifths of their disposable income to housing costs. This burden is heavier than for the general population, where just over eight percent face the same situation.

The combination of later independence and higher expenses underscores the challenges many younger Europeans face when trying to secure their own housing. Economic conditions, cultural expectations, and differences in national housing markets all play a role.

While the overall trend has been stable in recent years, analysts note that the affordability gap is widening for young people in several member states. This raises concerns about the long-term ability of younger generations to establish themselves independently in a period of rising living costs.

Source: Eurostat