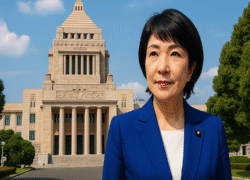

Japan is on the verge of a political milestone. For the first time in its history, the country is preparing to swear in a woman as Prime Minister after Sanae Takaichi secured victory in the ruling Liberal Democratic Party’s leadership contest. But while her appointment breaks a barrier in Japanese politics, it also signals a return to a more traditional and nationalist era that could redefine Japan’s domestic and foreign direction.

Takaichi’s rise marks the culmination of a career spanning three decades. Born in Nara Prefecture, she first entered politics in the early 1990s, eventually holding senior cabinet roles including ministerial posts overseeing communications and economic security. Known for her disciplined image and admiration for former Prime Minister Shinzo Abe, Takaichi built her reputation as a conservative loyalist rather than a reformist outsider.

Her ascent reflects both continuity and disruption. Within the Liberal Democratic Party, she has long represented its right-leaning faction, advocating a stronger military, a more assertive foreign policy, and closer alignment with Japan’s post-war traditional values. Yet her position as the country’s first woman to lead a government that has resisted female advancement for decades brings deep contradictions. She opposes key gender reforms such as dual surnames for married couples and female succession to the imperial throne, even as she becomes a symbol of women’s political advancement.

Economically, Takaichi inherits a delicate balance. Japan’s slow growth and rising cost pressures have frustrated households, while the Bank of Japan faces scrutiny over its gradual retreat from ultra-loose policy. During her campaign, she promised direct support to consumers, including potential tax cuts and cash handouts, rather than fiscal restraint. Her critics warn that these populist measures could strain public finances in the world’s most indebted major economy, while supporters view them as overdue stimulus for an economy long trapped in deflationary caution.

On the international stage, Takaichi is expected to adopt a more assertive tone. She has argued for strengthening Japan’s defensive capabilities and revisiting the constraints of the post-war constitution, which renounces war. That stance aligns with a growing consensus inside the security establishment but risks unsettling relations with China and South Korea, both sensitive to signs of Japanese militarisation. Her record includes visits to the controversial Yasukuni Shrine, a gesture that may play well with nationalists at home but often triggers diplomatic protests abroad.

Domestically, her leadership could test the unity of a party that has lost some of its post-Abe cohesion. Moderates in the LDP have expressed concern that her hardline positions may alienate centrist voters, particularly younger urban Japanese who prioritise social inclusivity and economic reform over ideology. Yet Takaichi’s disciplined style and reputation for decisiveness may also help stabilise a government shaken by successive leadership changes.

Her challenge will be to demonstrate that Japan’s first female prime minister can deliver more than symbolism. Supporters expect her to revive economic confidence and give Japan a stronger voice on the world stage. Critics fear she will consolidate conservative power while offering little in terms of gender equality or structural reform.

The coming months will show whether Takaichi can bridge that divide. Her victory has already reshaped Japan’s political narrative; the question is whether she can reshape its trajectory. As the world’s third-largest economy faces demographic decline, security uncertainty, and social change, her tenure will test whether Japan’s future will look more like its modern ambitions—or its traditional past.

Source: comp.