CBRE summarises this year’s developments in the Czech commercial real estate market and provides an up-to-date outlook for 2025. The report highlights anticipated investment activity and the evolution of key segments in the Czech Republic for the upcoming year.

Clare Sheils, Managing Director, CBRE Czech Republic, comments: “Supported by economic recovery, the 2025 market is expected to stabilize and grow, with investment volumes expected to rise. ESG considerations will remain a key focus for 2025 with a strong emphasis on energy efficiency, sustainable building practices, and reducing carbon footprints.”

The investment market is expected to continue its recovery

Improvement in the Czech real estate transaction market is set to continue in 2025. Key drivers will be an increase in product for sale and improved financing conditions.

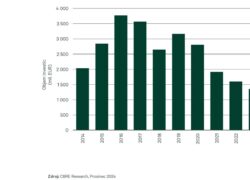

From January to November 2024, €1.36 bln has been transacted, which is already equal to the total volume for 2023. We expect to close this year with a total investment volume of around €1.5 bln. Several large transactions are currently in the final stages of negotiations, hence Q1 2025 is set to be a very strong quarter. CBRE expects total Czech commercial real estate investment volumes to far exceed €2 bln in 2025. Local investors will remain the key players, but the anticipated return of international capital could further strengthen the market.

Since mid-2022, prime yields in the Czech Republic have expanded by 60 – 135 basis points across office, retail, and industrial & logistics sectors. During H2 2024, we have monitored the stabilization of prime yields, and even the first compressions for Retail parks and High Street prime yields in Q4.

In recent years, investors have begun to place greater emphasis on portfolio diversification to minimize the risks associated with economic fluctuations. As a result, interest in investing in alternative segments such as rental residences, student campuses, or medical facilities is growing. At the same time, the sustainability of projects is gaining importance. Energy certificates and international certifications such as BREEAM or LEED are becoming key criteria when evaluating investment opportunities.

Jakub Stanislav, Head of Investment Properties at CBRE, adds: “While buyer sentiment has improved, interest rates are not expected to come down rapidly, and the room for materially improved bid prices is limited. Therefore, the recovery will be gradual, and it will take some time for investment volumes and capital values to return to their previous peak.”

Office market: Adapting to a New Era

We have seen signs of reviving office construction during 2024. There is currently more than 160,000 sq m of new office space under construction in Prague, although most of this space won’t be completed until 2027. The recovery of office construction is being led by the owner-occupied market, namely two of the largest Czech business institutions, however, we believe this may be the trigger for other projects to follow suit. We anticipate a supply gap in 2025 and 2026, during which only a total of 23,000 sq m is scheduled to be completed.

Even though some large tenants are continuing the gradual return of underutilized, secondary space, extremely low new deliveries will keep the vacancy level at below 8% next year. Cost is the main driver behind corporations reducing portfolio size, but other core aims such as quality, experience, and flexibility are also prominent.

Simon Orr, Director in A&T-Offices at CBRE, comments: “The current leasing market is slow as the market is adapting to a higher cost environment. The unanswered question for now is whether tenants will be willing to pay much higher rates for newly built offices and increase their real estate costs as a result.”

Next year we expect that around 240,000 sq m will be newly leased, slightly below the 10Y average of 280,000 sq m. There are still relatively few new occupiers entering the Prague office market. These newcomers tend to start up in flexible office space and the flex market in Prague, which continues to grow, is benefiting from that trend.

Helena Hemrová, Head of A&T – Offices at CBRE, adds: „In 2025, we expect a rise in office-based employment and clearer signs of settled working practices.”

We observe a growing gap in rental levels between secondary and prime premises. Current prime rents stand around 29 EUR/sqm/month and we expect only a marginal increase during next year. Due to slow leasing take-up we are seeing upward pressure on incentives in certain locations.

Industrial & Logistics market: Getting used to the new normal

This year, industrial & logistics take-up should stay around 800,000 sq m representing a y-o-y decrease by 15%. Next year, take-up volumes might remain at the same level, or even stay slightly below 2024 levels. In Q4, we have registered a slight revival of new demand, which is a positive sign after the cooler beginning of the year.

Jan Hřivnacký, Head of Industrial Leasing at CBRE, comments: “But only the start of 2025 will show if it is just the effect of the end of the year, or the beginning of a new trend. Currently, we are unaware of any XXL transaction that would boost the 2025 volume. We believe we cannot expect 2021 and 2022 levels of take-up to repeat again.”

Demand in 2024 has been driven by manufacturing companies, which accounted for 60% of overall take-up during the first three quarters of 2024. Automotive has been the most active subsector with a 69% share. We feel that e-commerce activity is slowly growing, however, we will only see during next year if this activity will be projected in real leasing transactions.

As of Q3 2024, there was more than 1 million sq m under construction. However, we are now seeing that new construction is slowing down. Developers are waiting for preleases and this trend will continue through 2025. This year we expect around 700,000 sq m to be newly delivered to the market, which would represent almost a 15% decrease compared to 2023.

The vacancy rate has been continuously increasing throughout the year. As of Q3, the vacancy rate stood at 3.1% and we expect to see another slight increase in Q4. We continue to monitor grey vacancies on the market, not only in the space offered for subleases but also in projects at the stage just before completion and designated as under construction until the space is leased.

In 2025, we expect the vacancy rate might slightly increase further, but not as fast as in 2024.

As a result, we might see downward pressure on prime rents to continue through 2025 in some of the most competitive regions.

Czech Retail 2025: Set for a growth

In 2024, retail development in the Czech Republic was driven mainly by retail park construction. Currently, we monitor more than 100,000 sq m in various stages of construction and planning within retail parks. In terms of shopping centre stock, we expect ca 43,000 sq m to be delivered to the market in 2025, all of which are either refurbishments or extensions of existing schemes. The vacancy rate in existing shopping centre stock remained low at around 4%.

Improved consumer fundamentals are acting positively on shopping centre performance. Retail sales increased by almost 5% y-o-y, well above the rate of inflation, and have similar dynamics to the European average. Footfall is stable, with 1% growth y-o-y.

The real retail spend growth in the Czech Republic presents a compelling narrative of recovery and resilience. Starting with a year-on-year growth of 3.9% in the first quarter, the momentum has been sustained and even surpassed expectations, reaching an impressive 5.3% by the third quarter. For the entirety of 2024, the growth rate is projected to be around 4.3% y-o-y. In 2025, growth is expected to continue at a steady pace, with a forecasted rate of 4.1% y-o-y.

Jan Janáček, Head of Retail Sector and A&T-Retail at CBRE, adds: “After several years of stagnation in the construction of new shopping centres, we see a significant trend in the modernization of existing schemes, for instance: Central Most, Varyáda, Velký Špalíček, Grand Pardubice or Forum Pardubice. With decreasing cost pressures and improving retailers’ expansion appetite, we expect an increased volume of investment in retail schemes in the coming years.”

Prime retail rents have shown a notable upward trend in 2024, driven by a surge of occupier demand and persistently low vacancy rates in prime retail locations. High street prime rents have increased by 3% year-on-year and are projected to see a similar growth of 3% in 2025. Shopping centre prime rents have experienced a more robust growth of 4% year-on-year in 2024, with an anticipated increase of 2% in 2025.

In 2024, we saw increased activity on Prague’s High Street market. In June, Máj opened adding 17,000 sq m of retail space to the Prague market and bringing new entries. In autumn, tenants such as Boss, Vasky and Tommy Hilfiger opened their stores in the newly reconstructed building 100Yards. The street 28. října has been developing and qualitatively extending Na Příkopě Street. This year, the street has been strengthened by the flagship store of Lindt, and Desigual. In the upper part of Wenceslas Square, the long-awaited revitalization has begun. This will bring a tram line from Vinohrady to the square and the construction work will last until the summer of 2027.

Zdeněk Zádrapa, Head of High Street & Tenant Representation at CBRE, adds: “The Czech Republic is increasingly recognized as a prime destination for international brand expansion. We expect the full year of 2024 to be one of the strongest years in tracked history. This trend is anticipated to continue, with further entries expected next year, reflecting the Czech Republic’s growing appeal as a vibrant market for global retailers.”