Central Group achieved significant milestones in 2024 by completing nearly 1,100 new apartments, providing homes for more than 2,000 residents. With its ambitious plans for the future, the company currently has a record-breaking 3,200 apartments worth over CZK 25 billion under construction, the highest in its history. Central Group also plans to launch the construction of an additional 1,600 apartments this year.

Preliminary figures indicate that last year’s sales of new apartments in Prague rivaled the record year of 2021. Central Group recorded a remarkable 60% year-on-year increase in sales, selling over 1,000 new apartments.

In mid-2024, Central Group completed two key projects: the Kotlaska Residence near the Palmovka metro station, featuring luxury apartments, and the first phase of its flagship project, Park Quarter in Nový Žižkov, which includes nearly 390 apartments. By the end of the year, the company delivered two more major developments: the U Hostivařské přehrady project with 290 apartments and the first stage of the Tesla Hloubětín residential district with 350 apartments. Tesla Hloubětín became the best-selling project on the Prague market last year, with over 350 units sold across all phases.

Central Group is poised for another strong year, with around 3,200 apartments currently under construction and plans to sell approximately 1,500 new units in 2025. The company’s goal is to reach annual sales of 2,000 apartments by 2026.

“Demand for housing is expected to grow even further,” said Jana Martínková, Sales Director at Central Group. “Our record level of construction ensures we can meet this demand, with 1,600 new apartments set to break ground this year. These projects will gradually become available for sale over the next two years.”

Central Group continues to expand its development portfolio through strategic acquisitions. Last year, the company finalized the purchase of a major site in Karlín, one of the largest real estate transactions in the Czech market in 2024. The developer’s pipeline now includes more than 35,000 apartments, accounting for approximately 25% of all planned residential units in Prague.

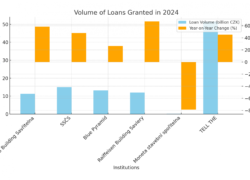

Despite high bank margins and a gradual reduction in mortgage rates in 2024, the mortgage market saw significant growth. Central Group anticipates this momentum will carry over into 2025, particularly as banks compete for clients early in the year, potentially accelerating the decline in rates.

“With improving mortgage conditions, we are optimistic that demand for housing will remain strong throughout 2025,” Martínková added. “We plan to launch around 2,000 new apartments this year, including ongoing phases of Park Quarter, the best-selling luxury apartment project in Prague, and Tesla Hloubětín, which leads the market overall. We are also preparing several smaller projects and new developments.”

Central Group’s robust development pipeline and strategic focus on high-demand areas position the company to maintain its leadership in the Czech residential market. With favorable market conditions and continued growth in demand, 2025 is set to be another transformative year for the developer and the Prague housing market.

Source: Central Group