Kosovo has successfully concluded its Stand-By Arrangement (SBA) and Resilience and Sustainability Facility (RSF) with the International Monetary Fund (IMF), marking a pivotal milestone in its macroeconomic stabilization, fiscal reform, and green transition strategies. The final review by the IMF Executive Board in May confirmed that all program targets had been met, enabling the disbursement of approximately €25.4 million across both arrangements. This positive conclusion reflects Kosovo’s commitment to prudent fiscal management and structural reforms, even amid geopolitical uncertainty and external economic headwinds.

The SBA, which the authorities treated as precautionary, was instrumental in anchoring Kosovo’s macroeconomic framework. It supported the country in maintaining low fiscal deficits and public debt while enhancing fiscal transparency and crisis preparedness. Simultaneously, the RSF facilitated reforms aligned with Kosovo’s 2030 climate targets and broader energy transition plans, including investments in renewable energy and efficiency improvements .

Strong Macroeconomic Fundamentals in 2024

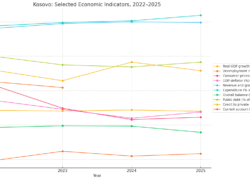

Kosovo’s economic performance in 2024 was notable. Real GDP expanded by 4.4%, supported by robust private consumption, real wage growth, and dynamic credit expansion. Household consumption alone contributed nearly five percentage points to GDP growth, while increased public and private investment, particularly in real estate and infrastructure, added further momentum .

Inflation, a concern in previous years, decelerated significantly. Average consumer price inflation fell to 1.6% in 2024, down from 4.9% in 2023 and 11.6% in 2022. This decline was largely attributed to lower food and energy prices. However, a slight rebound in inflation was recorded in early 2025 due to higher food prices and a 16% increase in electricity tariffs .

Despite these achievements, Kosovo’s current account deficit widened to 9% of GDP, driven by rising imports and slowing remittance inflows. Export performance was dampened by weak external demand, particularly in minerals and metals. The fiscal deficit remained modest, and public debt declined to 16.9% of GDP in 2024, well below regional averages .

Fiscal Discipline and Investment in Human Capital

The fiscal strategy under the SBA emphasized sound budgeting, targeted investment, and enhanced revenue collection. Stronger tax administration, including measures to reduce smuggling and improve compliance, led to higher revenues. Non-tax income also rose due to increased central government fees. Capital investment execution improved significantly, reaching 76% of planned allocations, compared to 65% in 2022 .

Social support measures were balanced with fiscal prudence. While there were increases in pensions and a one-off child allowance, current expenditures were carefully managed. Public investment in infrastructure and human capital continues to be prioritized to meet Kosovo’s long-term development goals .

The IMF praised Kosovo’s adherence to its rules-based fiscal framework and called for its continued alignment with EU norms. Efforts to reform compensation systems, increase targeting of social benefits, and strengthen public investment management remain central to medium-term fiscal planning .

Advancing Financial Sector Reforms

Kosovo’s financial sector remains stable, with banking institutions showing solid capitalization, profitability, and liquidity. Private sector credit grew by 18.3% in 2024 and is expected to continue expanding in 2025, though at a slightly slower pace. The Central Bank of Kosovo (CBK) has improved risk monitoring capabilities and is developing tools to address systemic liquidity and macroprudential concerns .

Under the SBA, the CBK adopted a Supervisory Review and Evaluation Process (SREP) to assess the risk profile of financial institutions. It also supported financial inclusion by encouraging commercial bank expansion in northern Kosovo. The number of bank branches in the region rose from four to twelve within a year, enhancing access to finance .

Efforts are underway to integrate Kosovo’s financial system more closely with European frameworks. In late 2024, Kosovo submitted its SEPA pre-application and joined the regional instant payments initiative (TIPS Clone) led by the Bank of Italy, aimed at enabling seamless cross-border transactions in the Western Balkans .

Green Transition and Climate Resilience

A hallmark of the RSF arrangement has been Kosovo’s progress in accelerating its green transition. Two major renewable energy auctions—150 MW of wind and 100 MW of solar—are set to double the country’s renewable generation capacity. These projects, alongside the integrated electricity market with Albania (ALPEX), position Kosovo as a regional player in clean energy .

The government’s 2022–2031 Energy Strategy and new climate law establish the framework for emissions reductions. Kosovo aims to cut emissions by 16% by 2030 and cover 35% of electricity consumption through renewables. Implementation of EU-aligned carbon policies and the Carbon Border Adjustment Mechanism (CBAM) preparedness have been supported with IMF technical assistance .

Energy efficiency is also a priority. The Kosovo Energy Efficiency Fund (KEEF), backed by €86 million in donor and institutional funding, is scaling up residential and public building retrofits. Reforms to improve pollution control at coal plants and launch new clean energy laws further illustrate the country’s commitment to climate goals .

Institutional Reforms and Governance

Kosovo’s structural reform agenda has expanded to improve public sector governance, boost competitiveness, and align with EU accession benchmarks. Actions include enhancing the integrity of the judiciary, implementing digitalization across public services, improving tax administration, and reducing informality in the economy .

To enhance policymaking, Kosovo is upgrading its statistical capacity. The IMF is assisting the Kosovo Agency of Statistics (KAS) to strengthen GDP measurement, produce a Residential Property Price Index, and move toward accrual-based government finance statistics aligned with EU standards .

Efforts to foster inclusive growth also continue. Initiatives to close gender gaps, raise labor force participation—especially among women—and invest in education and health are aligned with IMF recommendations. Reforms in human capital development are expected to improve employment prospects and long-term productivity .

Risks and Outlook

While the medium-term economic outlook is favorable, the IMF noted several downside risks. These include prolonged delays in government formation following the February 2025 elections, rising geopolitical tensions in the region, and external shocks such as higher global commodity prices or a slowdown in major European economies .

Inflation is expected to stabilize around 2.3% in 2025. Growth will likely remain robust, projected at 4% for the year. However, the current account deficit, while narrowing slightly due to lower commodity prices, remains structurally high. Sustained reform momentum and foreign investment, especially through EU integration, will be critical to mitigating vulnerabilities .

The IMF emphasized that Kosovo’s continued access to international financing, including diaspora capital, and resilience-building reforms will help safeguard economic stability. A potential financing gap of €50 million was identified under an adverse scenario involving energy or food price shocks .

Conclusion

The completion of Kosovo’s SBA and RSF reviews marks a significant achievement for the country’s macroeconomic stability and reform agenda. With fiscal prudence, ambitious climate action, and institutional strengthening, Kosovo is better positioned to address both its developmental needs and regional integration ambitions.

Looking ahead, the IMF’s engagement with Kosovo will continue through surveillance and capacity development. The Fund’s support has laid the groundwork for future growth, while reinforcing Kosovo’s ability to navigate global economic uncertainty and deliver inclusive, sustainable progress.