ESG, Flexibility, and Investment Shifts: CBRE’s Jana Prokopcová on the Future of Czech Commercial Real Estate

In a recent CIJ EUROPE Q&A with Jana Prokopcová, Head of Research at CBRE Czech Republic, we discussed how ESG standards, changing occupier expectations, and evolving investment strategies are reshaping the Czech commercial real estate market. From retrofitting legacy office and retail assets to emerging trends in sustainability and flexibility, Prokopcová offers a detailed look at how developers, landlords, and investors are responding to new pressures and opportunities across the sector.

How are developers and landlords in the Czech Republic responding to the growing pressure to retrofit or reposition older office and retail properties to meet ESG and tenant expectations?

Developers and landlords in the Czech Republic are increasingly focused on retrofitting older properties to meet modern ESG benchmarks and tenant expectations. In the office segment, outdated buildings are being upgraded to improve energy performance, reduce environmental impact, and enhance indoor comfort. Renovations often involve modernizing infrastructure and creating flexible, hybrid-ready workspaces to keep pace with shifting workplace models and maintain market competitiveness.

What specific ESG-related requirements—such as certifications, energy efficiency upgrades, or reporting obligations—are now most critical for maintaining asset liquidity and investor interest?

ESG performance is becoming central to maintaining asset value and liquidity. Energy efficiency improvements—particularly those that result in better EPC (Energy Performance Certificate) ratings—are seen as essential. Certifications such as BREEAM, LEED, and WELL are also increasingly important. Banks and financial institutions are aligning green financing terms with a building’s energy profile, making high EPC ratings a key factor in securing capital and attracting institutional investors.

From an occupier perspective, how have tenant demands changed in recent years and what are the most important features now being requested in office and retail leasing negotiations?

Office occupiers now prioritize flexibility, modular layouts, and health-focused features like air quality and natural light. Hybrid work models have led to new requirements in space planning. Sustainability is also a major driver: according to CBRE’s European Office Occupier Sentiment Survey, 84% of occupiers now consider sustainable building features a priority, with growing demand for bike and scooter storage (80%) and EV charging stations (69%). In retail, tenants increasingly focus on experiential environments, integrated digital capabilities, and operational efficiency tied to sustainability targets.

How are investment strategies evolving in light of increased regulatory oversight and sustainability criteria, particularly for legacy retail or non-core office assets?

Older retail and office assets are now viewed through a value-add lens—provided they can be upgraded to meet current regulatory and ESG expectations. Investors are split in their strategies: some are divesting from underperforming assets without viable ESG potential, while others are acquiring properties that can be repositioned to meet higher standards. The direction depends on risk appetite and long-term investment horizon, but ESG compliance is becoming a fundamental consideration in both cases.

What types of commercial properties are currently seen as most resilient or attractive in the Czech market and how important is flexibility in use or design to future-proofing their long-term value?

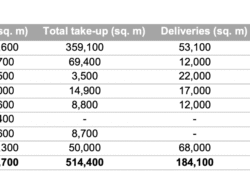

The Czech commercial real estate investment market had a strong start to the year, with €2.2 billion transacted in H1 2025—already exceeding the full-year 2024 volume of €1.98 billion. We’re seeing investment activity across all sectors. In H1, industrial assets led with a 27% share of total volume, followed by hotels (23%) and offices (17%). However, these proportions are likely to change over the course of the year, depending on the successful closing of several large ongoing transactions.

Flexibility in design and use is becoming increasingly important—not only to accommodate evolving tenant requirements but also to safeguard long-term asset value. Investors are also diversifying into alternative sectors such as rental housing, student accommodation, and healthcare facilities to hedge against market volatility and enhance resilience.