Catella Investment Management (CIM) has completed the acquisition of a residential complex in Vienna’s 21st district, Floridsdorf, on behalf of its Article 9 fund, Catella European Residential III (CER III). The property, built in 2014, consists of three fully-let buildings with a total of 192 apartments and approximately 15,900 square meters of gross living space.

The apartments range in size from 53 to 127 square meters, averaging 83 square meters, and each unit features a private garden or balcony, parquet flooring, and external blinds. The buildings are classified in energy efficiency class B (HWB) and are heated through district heating. A solar thermal system installed on the roof contributes to hot water production.

Michael Keune, Managing Director of CIM, said the acquisition reflects the fund’s commitment to affordable, sustainable housing: “With CER III, we are investing in affordable and modern residential projects in European growth regions. This asset class has proven to be highly resilient, even in challenging market conditions, while providing much-needed rental housing. Alongside social aspects, ecological criteria are central to the fund. Around half of Vienna’s district heating is already generated from industrial waste heat, biomass, geothermal energy, or ambient heat, and the city aims to achieve a fully climate-neutral district heating supply by 2040.”

Benjamin Rüther, Head of Fund Management at CIM, emphasized the appeal of the property: “The complex offers efficient layouts, modern amenities, a communal area, and a children’s playground. It is situated in a green, family-friendly area with good local infrastructure and schools, ensuring residents enjoy a high quality of life in an attractive location.”

Floridsdorf benefits from strong transport links, with bus connections, nearby underground stations, and Siemensstraße S-Bahn station within walking distance. The city center can be reached in about 30 minutes by public transport, while proximity to the S2 and A22 motorways ensures good road connections to Vienna’s wider metropolitan region.

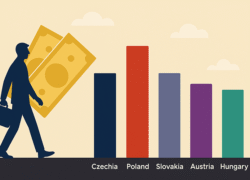

Launched in 2019, CER III invests in residential properties with high energy standards and affordable rents across European growth markets, including Germany, Austria, the Benelux countries, France, Scandinavia, Spain, and the UK. The fund currently manages assets worth around €1 billion.