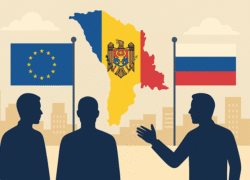

Moldovan voters will go to the polls on September 28 in a parliamentary election that could reshape the country’s direction between closer integration with the European Union and renewed alignment with Russia. The outcome is expected to hinge on a handful of smaller parties whose performance could tip the balance of power.

The pro-European Party of Action and Solidarity, closely tied to President Maia Sandu, is seeking another mandate after a term focused on judicial reform, fighting corruption, and opening negotiations with Brussels. Its leaders argue that EU membership is the only path to long-term stability, investment, and security. The party promises to stay the course on energy diversification and infrastructure modernization while keeping fiscal policy under control.

Challenging them is a left-leaning Patriotic Bloc built around the Socialists and allied groups, which argues that Moldova’s future lies in strengthening ties with Russia. It presents cheaper energy deals, social spending, and price controls as immediate answers to rising living costs. The bloc portrays itself as a defender of neutrality and warns against what it calls the risks of moving too quickly toward Brussels.

A newer player, the “Alternative” alliance, has gained attention by positioning itself between the two poles. Backed by Chișinău mayor Ion Ceban and several former senior officials, the group says Moldova should continue working toward EU membership but at a more pragmatic pace. It emphasizes social spending, wage growth, and job creation while pledging to improve governance at the local level.

Another factor is Renato Usatîi’s “Our Party,” a populist force that focuses less on geopolitics and more on municipal improvements and tackling corruption. While smaller, its support could prove decisive in post-election negotiations.

Notably absent from the ballot are parties linked to Ilan Șor, the fugitive businessman whose organizations were banned for alleged attempts to destabilize the country. Many of his supporters remain active, however, and their votes will be redistributed among the remaining options.

The stakes are high because Moldova’s 101-seat parliament is elected entirely through a nationwide vote, with a five percent threshold for parties and seven percent for blocs. This makes the performance of smaller parties critical: if they cross the line, they can determine who governs; if they fall short, the leading party gains a large seat bonus.

Recent surveys suggest the pro-EU and pro-Russian blocs are running close, making coalition building inevitable. A government led by the ruling party could push ahead with EU reforms, likely with support from Alternative or Our Party. A left-wing coalition, by contrast, would prioritize cheaper energy from Moscow and a slower approach to Brussels, though it would also need the backing of smaller centrist or populist groups.

Voter concerns are dominated by high living costs, jobs, and corruption, alongside the shadow of Russia’s war in neighboring Ukraine. Diaspora participation, traditionally a boost for pro-European forces, may once again play a crucial role.

For Moldova, the election will not only decide who holds power in parliament but also how the country navigates its most important choice since independence: whether to anchor itself more firmly within Europe or to re-engage with Russia.