The Polish labour market is beginning to show early signs of a slowdown. Although many workers say they found their current jobs relatively quickly, a growing number believe that job-hunting today takes longer than in recent years — especially among the youngest adults and women.

According to the latest edition of the Barometr Polskiego Rynku Pracy published by Personnel Service, employee sentiment has weakened since mid-2025. More than two in five respondents believe that finding a new job is now more difficult than two or three years ago. This perception is particularly widespread among people aged 18 to 24, who are entering a softer job market after years of strong hiring.

Official data support the impression of a labour market losing some momentum. The Central Statistical Office (GUS) reported that the number of job vacancies fell to 95,700 in the second quarter of 2025 — down by more than 15,000 compared to the same period last year. The vacancy rate now stands at 0.78 %, its lowest level in several quarters.

While Poland’s overall unemployment rate remains low by European standards — at 5.4 % in July 2025, according to GUS — economists warn that the youth jobless rate is still in double digits. Under the EU’s harmonised Labour Force Survey (BAEL) methodology, unemployment among people aged 15-24 hovers around 11 %, signalling difficulties for new entrants.

“The first groups to feel a slowdown are always the youngest, whose lack of experience makes them more vulnerable when companies scale back recruitment,” said Krzysztof Inglot, labour-market expert and founder of Personnel Service. “It’s a warning signal that the market is becoming more selective.”

The company’s earlier survey results also suggest that women perceive greater difficulty in finding work than men. Analysts link this to structural shifts in services and administrative sectors, where automation and cost-cutting are reducing hiring activity.

Despite these challenges, most respondents said they found their current jobs within three months, and overall employment in Poland remains high. Yet growing concern about slower hiring suggests a turning point after several years of near-record job creation.

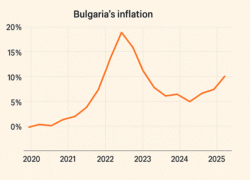

Economists expect the cooling trend to continue into 2026, in line with weaker GDP growth and tighter budgets in many industries. However, they note that Poland’s strong manufacturing base and foreign investment pipeline could help cushion the slowdown, especially if inflation and interest rates continue to ease.

Source: Personnel Service