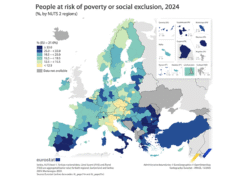

Across Central and Eastern Europe, poverty rates are falling — yet the divide between capital cities and rural regions is growing sharper. New Eurostat 2024 data reveal that while countries such as Czechia, Slovakia, Poland, Hungary, and Romania continue to make measurable progress in reducing the risk of poverty or social exclusion, economic opportunity remains concentrated in metropolitan centres, leaving large areas behind.

The EU’s average rate of people at risk of poverty or social exclusion stands at 21%, a figure that masks striking contrasts between and within member states. In 93 of the EU’s 243 regions, rates exceed this threshold, while in another 146, they remain below it. Within the Visegrád and Balkan nations, the picture is one of gradual convergence — but also deep internal inequality.

Czech Republic: A Model of Stability

Czechia continues to perform among the best in Europe, with six of its eight regions reporting poverty rates below 12.5%. The Jihozápad region recorded 8.8%, the third-lowest rate in the EU, while Prague also ranks among the continent’s most socially resilient cities.

Experts credit Czechia’s success to its low unemployment, strong industrial base, and balanced social welfare system. However, disparities persist between the prosperous western and central regions and the more industrial, less developed northeast. Analysts warn that the rising cost of living could challenge this balance if wages stagnate or housing affordability worsens.

Slovakia: Prosperity Clustered in Bratislava

Slovakia’s Bratislavský kraj is the EU’s second most resilient region, with only 8.6% of its population at risk of poverty or social exclusion. Yet other regions such as Banskobystrický and Prešovský continue to face poverty levels several times higher, illustrating Slovakia’s “two-speed economy.”

Despite strong wage growth and EU-backed infrastructure spending, inflation and rural job scarcity remain key concerns. Policymakers are focusing on attracting investment outside the capital, but economists say long-term solutions must include improving digital access, education, and youth employment in the country’s less developed east.

Poland: A Story of Contrasts

Poland’s overall poverty rate remains below the EU average, driven by steady economic expansion and strong employment. However, a stark east–west divide endures. The Warszawski stołeczny capital region ranks among the EU’s top performers, while eastern regions such as Lubelskie and Podkarpackie lag significantly behind.

Urban areas have benefited from foreign investment and manufacturing growth, while rural and agricultural regions face weaker infrastructure and fewer job opportunities. Analysts warn that without renewed regional investment, Poland risks a permanent social split despite its national-level success.

Hungary: Slow Gains Shadowed by Inequality

Hungary has made gradual progress in reducing social exclusion, though regional inequalities persist. The Közép-Dunántúl region in the northwest, home to automotive and technology industries, ranks among the EU’s strongest performers. But the eastern and northern regions — notably Észak-Alföld and Észak-Magyarország — remain among the poorest.

High inflation, which hit double digits in parts of 2024, has eroded real incomes, particularly for lower-income households. Analysts argue that Hungary’s poverty reduction efforts have been slowed by weak education and healthcare systems and a concentration of investment in Budapest and western industrial zones.

Romania: Urban Progress, Rural Struggle

Romania presents one of the EU’s most pronounced urban–rural divides. The Bucharest-Ilfov region, with a poverty rate below 12.5%, rivals Central Europe’s most prosperous areas. But the Nord-Est and Sud-Vest Oltenia regions continue to struggle, with over 30% of residents at risk of poverty or social exclusion.

Rising wages and EU-funded infrastructure projects have lifted millions out of poverty, yet rural poverty remains deeply rooted. Over 45% of Romanians still live in rural areas, many without access to quality education, healthcare, or housing. Inflation and energy costs have also weakened purchasing power, particularly for pensioners and low-income families.

A Common Challenge: Growth Without Inclusion

Across the region, the pattern is clear — economic success is concentrated in capital regions, while rural and post-industrial areas lag behind. Bratislava, Prague, Warsaw, Budapest, and Bucharest all report some of the lowest poverty risks in the EU, reflecting how national statistics often mask uneven development.

Analysts note that EU cohesion funds have helped narrow these gaps, but the pace has slowed amid inflationary pressures and administrative bottlenecks. As the bloc prepares for its next funding cycle, policymakers in Central and Eastern Europe face a critical task: ensuring that prosperity extends beyond their capitals.

For now, the story of the region is one of dual realities — strong economic resilience, yet persistent inequality — a paradox that defines Europe’s new frontier between growth and inclusion.

Source: Eurostat “At Risk of Poverty or Social Exclusion 2024” (datasets ilc_peps11n and ilc_peps01n); national statistics offices of Czechia, Slovakia, Poland, Hungary, and Romania; CIJ EUROPE analysis.