The long-awaited revitalization of the Petržalka Lido, once a popular destination for swimming and leisure activities along the right bank of the Danube River, is finally moving forward with an updated zoning plan. Originally incorporated into the city’s urban development blueprint in 2006, the ambitious plan aimed to transform the area into a thriving hub featuring the Celestean Petržalka center, which encompasses both the Lido and the future Southbank district. However, despite initial enthusiasm, the project remained stagnant for nearly two decades.

Efforts to revive the plan gained momentum in recent years as city planners recognized the need for updated strategies to address the changing urban landscape and community needs. In 2023, Bratislava residents were given the opportunity to provide feedback on proposed changes to the locality, resulting in significant input that contributed to a comprehensive revision of the zoning plan. The updated plan introduces several key elements aimed at enhancing connectivity, sustainability, and livability in the area.

One of the most notable features of the revised plan is the incorporation of a tram line that will provide seamless transportation links between Petržalka and other parts of Bratislava. This new public transport initiative is expected to alleviate traffic congestion, promote eco-friendly mobility, and make the area more accessible for both residents and visitors. The tram network will complement existing infrastructure while encouraging a shift towards sustainable urban transit solutions.

In addition to improved transportation, the updated zoning plan envisions the development of hundreds of new rental apartments designed to accommodate the growing population and meet the increasing demand for modern housing options. These residential units will cater to a diverse range of inhabitants, from young professionals to families, and will be integrated with green spaces, pedestrian-friendly zones, and recreational facilities. Developers are planning a mix of high-rise and mid-rise buildings, ensuring a balanced and aesthetically pleasing urban environment that complements the natural beauty of the Danube waterfront.

The revitalization also aims to enhance the cultural and social appeal of New Lido by incorporating public amenities such as parks, waterfront promenades, cultural venues, and retail spaces. Plans include the creation of vibrant public squares, outdoor dining areas, and entertainment hubs that will foster a lively atmosphere and attract both locals and tourists. Additionally, developers are emphasizing eco-friendly construction practices, energy-efficient buildings, and sustainable water management systems to align with contemporary environmental standards.

Despite the prolonged delays, city officials and developers remain optimistic about the potential of the New Lido project to become a landmark development for Bratislava. With spatial planning nearing completion, the city is poised to witness a transformation that will redefine the right bank of the Danube as a dynamic, attractive, and sustainable urban district.

While the exact timeline for the project’s implementation remains uncertain, officials anticipate that initial construction phases could commence within the next few years. The revitalization of New Lido is expected to significantly contribute to Bratislava’s economic and social growth, offering new opportunities for business, leisure, and community engagement.

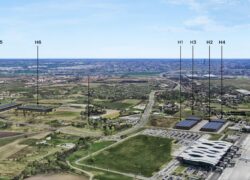

Photo: Nové Lido, JTRE