A new study by Omnisense, conducted on behalf of the Association of Polish Trade and Services Employers (ZPPHiU) and the Polish Association of Retail Tenants (PSNPH), has revealed that parking accessibility plays a crucial role in determining where Polish consumers choose to shop. According to the research, 73% of respondents consider the quality and availability of parking a key factor when selecting a shopping mall.

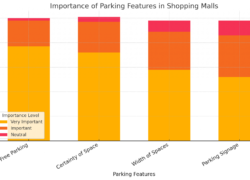

Among the most important parking features, 97% of consumers expect a free parking period of at least two hours, while 96% want assurance that they will find an available space. Other significant factors include the width of parking spaces (89%) and clear parking signage (85%). The study highlights growing consumer frustration over increasing parking fees and shrinking free parking periods, with some shopping centers, such as CH Sadyba Best Mall and Avenida Poznań, reducing free parking time to just one hour.

These findings come at a time when shopping center foot traffic is declining, making it even more crucial for malls to ensure a stress-free shopping experience. Customers need ample time to browse and make purchasing decisions, benefiting both retailers and mall landlords.

Retail Tenants Bear the Burden of Parking Costs

A key issue raised by the research is that parking expenses are already covered by tenants as part of common costs, yet revenues from parking fees are not accounted for within these expenses. Instead, they represent an additional revenue stream for mall owners.

Zofia Morbiato, Director General of ZPPHiU, emphasized the importance of maintaining free parking for at least two hours, stating: “Accessibility of the parking lot and the absence of short-term fees are essential in a shopping mall’s appeal. Tenants expect parking conditions to meet customer needs and uphold the mall’s basic standards. Despite tenants covering all parking costs through common charges, they never receive reductions when additional fees are introduced. Furthermore, these funds are rarely reinvested into improving parking conditions, such as better lighting and signage.”

Morbiato also pointed out recent cases where poor parking management caused significant disruption. She cited Galeria Młociny, where inadequate traffic flow led to long parking delays, forcing some shoppers to leave their cars overnight and return home on foot. She stressed that shopping center managers must take responsibility for ensuring a smooth and comfortable parking experience.

Beyond Parking: Other Key Customer Expectations

The Omnisense study also examined broader customer preferences in shopping malls, revealing that clean and free restrooms rank highest among consumer priorities. Key findings include:

• 91% of respondents value clean toilets, and 89% oppose restroom fees.

• 85% emphasize easy restroom access.

• 89% consider a strong retail mix important.

• 79% highlight thermal comfort as a factor in their shopping experience.

• 74% appreciate clear mall navigation and signage.

• 73% stress the importance of well-managed parking.

• 74% prioritize easy car access to the mall.

Less significant factors included floor materials, electricity sources, ceiling designs, and the type of glass used in storefronts.

Online Shopping Habits Drive Mall Visits

The research also confirmed that online shopping behaviors strongly influence foot traffic in shopping centers. 52% of shoppers visit malls after finding a product online, and another 52% visit to inspect an item they researched on the internet. Among younger consumers, this trend is even more pronounced:

• 72% of 18-24-year-olds visit malls after discovering a product online.

• 65% of 25-34-year-olds do the same.

• 58% of 35-44-year-olds also follow this pattern.

• 28% of all respondents visit shopping centers after seeing a product on social media, a figure that jumps to 54% among 18-24-year-olds.

Shopping Malls Face Declining Foot Traffic

Despite the online-to-offline shopping connection, mall traffic has been steadily declining. According to Proxi.cloud data for 2024, visitor numbers in shopping centers fell by nearly 3.5% compared to 2023, while the number of unique customers dropped by 3.1% year-on-year.

The decline is further reflected in retail sales figures, particularly in sectors most associated with shopping malls. Data from GUS (Poland’s Central Statistical Office) indicates that sales in categories such as textiles, clothing, footwear, furniture, electronics, and household appliances have been shrinking for over a year. While overall retail sales have seen slight increases, the shopping mall segment continues to struggle.

Industry Leaders Discuss Risks and Solutions at ZPPHiU and PSNPH Congress

These challenges were extensively discussed at the 3rd ZPPHiU and PSNPH Congress, where industry experts explored ways to protect tenants from rising operational costs. One key focus was the role of “green lease agreements”, which could help tenants manage investment expenses through strategic contract negotiations and cost control measures.

Additionally, the congress introduced new research on customer expectations and presented a tool designed to measure customer experience within shopping centers and individual retail spaces.

With foot traffic declining and parking fees deterring customers, the retail sector faces mounting pressure to enhance the shopping experience, streamline access, and leverage digital engagement to attract visitors. Whether shopping centers and landlords adapt to these evolving demands will play a crucial role in determining their future viability in an increasingly competitive retail landscape.

Source: ZPPHiU