Germany’s industrial sector is facing mounting pressure due to high production costs, structural inefficiencies, and shifting global economic dynamics. While political parties acknowledge the urgency of the situation, their proposed solutions—ranging from tax relief and investment incentives to electricity cost reductions—fail to address the core challenge: the technological investment trap. To restore competitiveness, Germany must adopt a pan-European, strategic industrial policy that fosters innovation, sustainability, and resilience.

German Industry at a Crossroads

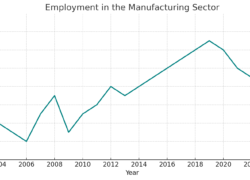

Recent economic indicators paint a grim picture for German industry. Production output has declined, order backlogs are shrinking, and major corporations—including Volkswagen, Miele, BASF, and ZF Friedrichshafen—have announced significant job cuts. Despite these warning signs, official statistics do not yet indicate full-scale deindustrialization. Industrial employment remains above 2010s averages, but below 2019 peak levels.

The current political discourse surrounding industrial policy is focused on short-term cost reductions, particularly in energy prices. Germany’s electricity costs remain 30% higher than pre-Ukraine war levels, leading policymakers to propose grid fee coverage and electricity tax reductions. While such measures may provide temporary relief, they do not address the deeper structural issues preventing long-term industrial growth.

Energy Costs vs. Structural Competitiveness

Energy costs, while significant, are not the primary burden for most German industrial sectors. 87% of manufacturing output comes from industries where energy costs represent only 5% or less of total expenses. By contrast, labor costs account for around 21%, with even higher impacts in some sectors. This suggests that focusing solely on energy cost reductions is insufficient to restore Germany’s competitiveness.

To truly revitalize the industrial sector, Germany needs a forward-thinking, investment-driven strategy. Current policies fail to stimulate breakthrough innovation in areas such as electromobility, hydrogen technology, and semiconductor production. These sectors require systemic investment coordination to overcome market failures and unlock long-term economic potential.

The Role of a European Industrial Strategy

The challenges facing German industry are not just national but global. Decarbonization, supply chain disruptions, and geopolitical shifts necessitate a pan-European response. Germany alone lacks the financial and production capacity to pioneer climate-neutral technologies at scale. A coordinated EU-wide industrial policy is essential to secure the country’s long-term economic resilience.

The U.S. and China have already embraced interventionist industrial policies—the U.S. through tax incentives under the Inflation Reduction Act (IRA), and China through direct subsidies and state-owned enterprises. Europe, however, faces legal and financial constraints that prevent a similar unilateral approach.

One existing European mechanism, Important Projects of Common European Interest (IPCEI), has supported microelectronics, battery cell production, and hydrogen technology. However, for IPCEI initiatives to fully realize their potential, they must be expanded, better funded, and implemented with greater efficiency and transparency.

A Strategic Shift in Industrial Policy

Germany’s industrial policy must go beyond short-term tax relief and cost-cutting measures. A comprehensive, long-term approach should focus on:

• Promoting key technologies such as semiconductors, digital infrastructure, and climate-friendly solutions.

• Enhancing supply chain resilience through diversification, regional production, and strategic stockpiling.

• Encouraging coordinated investment across European partners to avoid market fragmentation.

• Targeting public funding toward innovation-driven projects rather than subsidizing operational costs.

Conclusion: Germany’s Path to a Competitive Future

Germany’s industrial sector is at a critical juncture. While deindustrialization is not yet a reality, failing to implement a strategic, competitive industrial policy could accelerate decline. The current focus on tax breaks and energy cost reductions does little to address structural weaknesses. Instead, Germany must embrace an investment-driven, pan-European approach to remain an industrial leader in the decades ahead.

A stronger, more efficient IPCEI framework, increased EU-wide coordination, and targeted support for breakthrough technologies will be essential to ensure that Germany and Europe stay competitive on the global stage.

Source: DIW Berlin