Economic sentiment in Poland’s regions showed a mixed picture in February 2025, with negative trends dominating in manufacturing, construction, and wholesale and retail trade. The regional business climate indicator (R-BCI) recorded negative values in most voivodeships for these sectors. However, services, particularly in information and communication, displayed greater resilience, with several regions reporting positive business sentiment.

Compared to the same period in 2024, the overall economic climate improved in the services sector, with at least half of the voivodeships reporting an increase in the R-BCI. Retail trade also experienced an improvement in eight voivodeships, reflecting a modest recovery in consumer confidence.

Month-on-month comparisons indicate a gradual improvement in business sentiment across multiple sectors. At least seven voivodeships reported higher values of the regional business climate indicator in all analyzed economic areas compared to January 2025. Despite this, most entrepreneurs across sectors (except for those in information and communication) anticipated a deterioration in their firms’ economic conditions over the next three months.

Industrial and Construction Sectors Under Pressure

The manufacturing sector remained under strain, with most voivodeships reporting negative business sentiment. The most pessimistic assessments came from the Podlaskie, Łódzkie, and Śląskie voivodeships, where the R-BCI fell to -8.3, -6.9, and -6.4, respectively. These declines were primarily driven by concerns over current economic conditions and uncertainty about the future.

However, some positive signs emerged. Entrepreneurs in Mazowieckie (6.8), Małopolskie (4.9), and Podkarpackie (2.4) voiced more optimism, citing stable business conditions and expectations of gradual improvement.

In the construction sector, economic sentiment was predominantly negative across most regions. The worst assessments came from Pomorskie (-14.5) and Zachodniopomorskie (-13.7), where businesses struggled with declining orders and reduced construction activity. Positive evaluations were rare, with Podlaskie (9.3) and Mazowieckie (0.9) standing out as the only regions where expectations for the industry remained stable or slightly optimistic.

Entrepreneurs in construction indicated a continued decline in new orders and anticipated further reductions in activity over the coming months. While a few regions showed improvements compared to January 2025, overall business sentiment remained weaker than a year ago.

Rising Costs and Uncertainty as Key Barriers for Businesses

The primary constraint on business operations across all regions continued to be rising labor costs. This was particularly burdensome for companies in the accommodation and food services sector, where the percentage of businesses reporting labor costs as a major challenge ranged from over 7% to nearly 93%, depending on the region.

Economic uncertainty was another significant concern, especially for wholesale trade and transport businesses. Entrepreneurs cited unpredictable market conditions and unclear regulatory policies as key issues affecting their operations.

The burden of high state-imposed payments was also a major issue for construction firms, as well as for businesses in accommodation and food services. Despite these challenges, a small percentage of businesses in manufacturing and retail trade reported facing no significant barriers to their operations.

Retail Trade Sees Modest Growth Amid Challenges

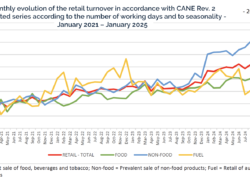

Despite the challenging economic environment, the retail sector exhibited moderate signs of recovery. The volume of retail trade in February 2025 increased by 4.7% compared to the same period in 2024, both in raw and calendar-adjusted terms. Growth was recorded across various retail segments, with food sales rising by 4.7%, non-food retail expanding by 5.6%, and fuel sales increasing by 1.9%.

Sales growth was particularly strong in pharmaceutical, medical goods, and cosmetics shops (9.7%), furniture and electrical goods stores (7.8%), and shops selling manufactured goods (6.7%). However, second-hand goods stores and bookshops saw only marginal increases, reflecting a divergence in consumer spending habits.

E-commerce remained a key driver of retail expansion, with mail order and internet retailing growing by 3.9%, accounting for 8.8% of total retail sales. Automotive fuel sales also experienced a slight boost, rising by 1.9%.

Wholesale Trade Struggles Amid Excess Inventory

While retail trade showed some resilience, the wholesale sector faced a more difficult environment. The R-BCI for wholesale trade was negative in most voivodeships, with Zachodniopomorskie (-11.6), Warmińsko-Mazurskie (-8.7), and Pomorskie (-7.4) showing the most pessimistic outlooks.

Businesses in wholesale trade reported declining sales and excess inventory levels as primary concerns. Many also expressed worries about deteriorating financial conditions. Forecasts for the coming months remained cautious, with expectations of continued weak demand and further economic difficulties.

Despite these concerns, business sentiment improved slightly in several regions compared to January, particularly in Lubelskie, where the R-BCI rose by 9.1 points. However, year-on-year comparisons showed a worsening outlook in nine voivodeships, with the sharpest declines recorded in Podkarpackie, Podlaskie, and Zachodniopomorskie.

Services Sector Shows Stronger Performance

In contrast to the difficulties faced by industry and trade, the services sector demonstrated greater resilience. The information and communication sector, in particular, recorded positive business sentiment in most voivodeships. Lubuskie (28.6), Świętokrzyskie (20.2), and Małopolskie (17.7) reported the most optimistic assessments.

Entrepreneurs in this sector expressed confidence in their current economic conditions, though forecasts for the coming months were mixed. In four voivodeships, business owners expected a downturn, while in six others, opinions were evenly split between optimism and pessimism.

Accommodation and food services also showed positive signs, with nine voivodeships reporting an overall optimistic outlook. Lubelskie (37.7) and Podkarpackie (34.2) recorded the highest R-BCI values. However, businesses in Pomorskie, Małopolskie, and Zachodniopomorskie were more cautious about the future, citing concerns over declining demand and financial uncertainty.

Investment Trends in 2025: Stability Over Expansion

An additional survey on investment expectations for 2025 revealed that most businesses anticipate maintaining investment levels similar to those in the previous year. This was especially pronounced in the information and communication sector, where over 70% of entrepreneurs planned to sustain their investment levels.

However, among firms expecting changes, more predicted a decline in investment than an increase. This trend was observed across nearly all economic sectors and regions.

Investment priorities for 2025 remain focused on machinery, equipment, and tools, particularly in manufacturing and construction. In the information and communication sector, companies plan to invest primarily in computer and telecommunications equipment, as well as research and development activities. Transport and storage businesses are expected to focus on upgrading their transportation infrastructure, while employee training remains a key investment area across all industries.

Outlook for the Coming Months

While February 2025 saw some improvement in business sentiment compared to January, economic uncertainty continues to weigh heavily on companies across various sectors. Rising labor costs, concerns about financial stability, and fluctuating demand are among the key challenges facing businesses.

Although the services sector, particularly information and communication, shows signs of resilience, manufacturing, construction, and wholesale trade remain under pressure. Entrepreneurs remain cautious in their outlook for the coming months, with most expecting further economic difficulties.

The investment climate remains stable but lacks strong growth momentum, indicating a wait-and-see approach among businesses. How these trends evolve in the coming months will depend on broader economic developments and policy measures to address business concerns.

Source: GUS