The real estate development industry in Poland continues to evolve, shaped by regulatory challenges, market conditions, and shifting consumer expectations. While large development companies have adopted modern practices and higher standards, public perception remains influenced by past industry shortcomings and the actions of smaller, less established firms. Jakub Sobczyński, Managing Director of Megapolis, one of the largest real estate sales companies in Kraków, discusses the current situation and the factors affecting the industry’s image.

Regulatory Challenges and Local Planning Issues

A key issue affecting real estate development is the lack of comprehensive local zoning plans in many Polish cities. Many investments proceed based on individual development conditions rather than structured, long-term urban planning. Even in cities like Kraków, some zoning documents date back more than a decade and do not reflect current needs. Local governments, despite their competencies, struggle to update plans quickly enough to adapt to economic and social changes, such as the impact of the pandemic on retail and office spaces. This lack of coordinated planning often results in chaotic urban development, which contributes to public criticism of the industry.

Housing Prices and Market Conditions

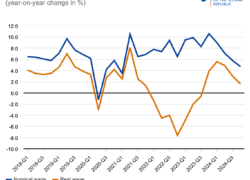

Rising apartment prices are another concern for buyers, but Sobczyński explains that developers are not the primary drivers of these increases. Housing costs reflect market conditions, financing costs, and rising wages in the construction sector. Banks play a significant role, as buyers not only take loans for their apartments but also indirectly cover financing costs incurred by developers for land purchases, construction, and contractor payments. Over the past two decades, housing prices have increased in parallel with average wages, as the cost of labor and materials continues to rise.

Public Perception and Industry Reputation

Public perception of developers is often shaped by limited personal experience and online discourse, rather than direct interactions with companies. Additionally, smaller, short-term developers that complete only a few projects before exiting the market may not prioritize long-term reputation or customer satisfaction. This contrasts with larger, established developers who implement structured procedures and quality standards.

The industry’s image is still influenced by past issues, particularly from the 1990s and early 2000s, when the sector was fragmented and professional standards were less established. While larger companies now dominate the market, smaller firms still exist, some of which may not operate with the same level of transparency or reliability. Scandals involving failed development projects, where companies sold unfinished properties before disappearing, have further shaped public distrust. Sobczyński emphasizes that choosing reputable developers with a strong track record is essential for minimizing risk.

Improving Industry Standards and Customer Focus

According to Sobczyński, larger developers must take responsibility for improving industry standards and transparency. Megapolis, for example, is a member of the Polish Association of Developers and follows the Code of Good Practices, aimed at addressing industry challenges and ensuring ethical business operations.

A key focus for Megapolis is customer satisfaction, ensuring that projects are developed with long-term livability in mind. The company avoids introducing innovations that may increase profits at the expense of buyers, instead prioritizing solutions that enhance functionality and value. During the pandemic, for example, coworking spaces were added to new developments to accommodate remote work, providing residents with dedicated spaces separate from their homes.

To maintain quality control, Megapolis has established its own internal contractor unit, overseeing all aspects of project execution. Unlike many large firms that outsource construction, this approach ensures consistency in building standards and customer service. Additionally, the company has an after-sales care department, staffed by engineers who manage maintenance and support for completed developments.

Megapolis also encourages community engagement, allowing residents to have a say in managing shared spaces. Through competitions and participatory decision-making, residents can choose property managers and influence aspects of their living environment.

Shaping the Future of the Development Industry

The real estate development industry in Poland is gradually improving its standards, transparency, and customer focus, though public perception remains influenced by past challenges and the actions of smaller, less reliable firms. Megapolis and other large developers aim to reshape the industry’s reputation by prioritizing quality, customer engagement, and ethical business practices. While the full impact of these efforts will take time to materialize, research indicates that the industry is moving in the right direction.

Source: Megapolis