Germany’s housing crisis has deepened as new data reveals that the country approved the construction of the fewest apartments in over a decade last year. The Federal Statistical Office (Destatis) reported that the number of building permits issued in 2024 fell sharply, highlighting the growing challenges facing the construction sector amid rising costs, regulatory hurdles, and economic uncertainty.

The decline in approvals marks the lowest level since 2012, underscoring the struggle to meet the government’s ambitious housing targets. In total, only around 230,000 new apartments received construction permits in 2024, a drop of 28% compared to the previous year. The slowdown is particularly concerning as Germany faces an acute housing shortage, with demand for affordable homes far outpacing supply, especially in major cities like Berlin, Munich, and Hamburg.

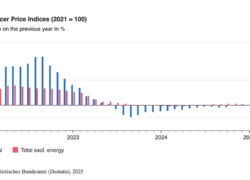

Experts attribute the downturn to a combination of factors, including soaring construction costs, high interest rates, and stricter environmental regulations. Inflation in building materials and labor shortages have made it increasingly difficult for developers to complete projects within budget, leading many to delay or cancel plans. Additionally, financial constraints caused by tighter lending conditions have discouraged investment in residential projects.

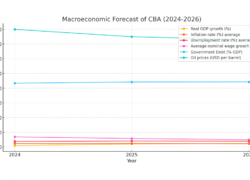

The situation presents a major setback for the federal government, which had set a target of building 400,000 new homes per year to address the housing shortage. The sharp drop in approvals signals that this goal remains far out of reach, raising concerns about rising rents and worsening affordability for millions of Germans.

“The figures are alarming and show that urgent action is needed to revive the housing market,” said Andreas Gey, a housing market analyst at the German Institute for Economic Research (DIW). “Without significant policy intervention, we risk seeing an even greater shortfall in new housing in the coming years, which will further drive up prices and put pressure on low- and middle-income households.”

In response to the crisis, the German government has pledged to introduce new incentives for developers, including tax breaks and subsidies for energy-efficient housing projects. However, industry leaders argue that more comprehensive measures, such as streamlining approval processes and reducing bureaucratic hurdles, are necessary to stimulate construction activity.

Meanwhile, housing advocacy groups warn that the slowdown in new developments will worsen homelessness and force more people into precarious living conditions. Calls for rent control measures and increased public investment in social housing have intensified as the crisis escalates.

With Germany’s housing shortage reaching critical levels, policymakers face mounting pressure to implement reforms that can accelerate construction and ensure that new housing supply keeps pace with demand. Whether the government’s planned measures will be enough to reverse the trend remains to be seen, but the latest figures highlight the urgent need for action to prevent a long-term housing crisis.