Poland’s industrial and logistics real estate sector maintained stability in 2024, remaining a key segment of the commercial property market both nationally and across Europe. Investment transactions in warehouse assets totaled EUR 1.26 billion, while take-up reached 5.8 million sqm, marking a 4% year-on-year increase. Although developer activity declined by 30%, new supply returned to pre-pandemic levels at 2.6 million sqm, with 1.8 million sqm still under construction. Vacancy rates remained stable at 7.5%, and rental levels showed little change from the previous year.

Investment Market Sees Recovery and Stabilization

The warehouse segment accounted for EUR 1.26 billion of total investment in 2024, a 27% increase year-on-year, representing 25% of all transactions. While retail and office assets saw exceptional growth, the industrial and logistics sector continued to attract stable capital inflows. Portfolio transactions played a significant role, comprising 58% of the total transaction volume. Notable deals included the acquisition of five 7R parks by Czech fund Investika and the purchase of three Diamond Business Parks by US investor Greykite.

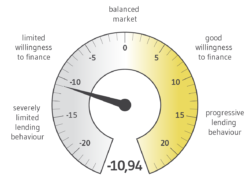

Grzegorz Chmielak, Head of Capital Markets & Valuations at AXI IMMO, noted that investors remained focused on key warehouse hubs such as Warsaw, Upper Silesia, and Poznań, where market fundamentals remain strong. He highlighted that portfolio transactions are often more cost-effective than new developments due to high construction and financing costs. By the end of 2024, prime big-box yields had stabilized at 6.5%, enhancing investment appeal.

Leasing Activity Driven by Renewals

Total leasing activity in 2024 reached 5.8 million sqm, up 4% year-on-year, with lease renewals comprising 48% of all transactions. This trend reflects businesses’ focus on operational stability and cost management. The most active regions were Mazowieckie (1.37 million sqm), Łódzkie (1 million sqm), and Dolnośląskie (891,000 sqm). Net take-up, which includes new leases and expansions, stood at 3.4 million sqm, maintaining last year’s level.

Retail tenants surpassed logistics firms as the largest demand driver, with major leases including a 103,800 sqm contract in Bydgoszcz Białe Błota LC, a 98,700 sqm renewal and expansion for a logistics operator at Prime Logistics Wrocław Pietrzykowice, and a new 91,000 sqm lease at Panattoni Wrocław Logistics South Hub.

Anna Głowacz, Head of Industrial at AXI IMMO, emphasized that companies are choosing to remain in existing locations to avoid relocation costs and maintain stability. She also highlighted a growing interest in environmentally certified buildings, reflecting the increasing implementation of ESG strategies.

Supply Returns to Pre-Pandemic Levels

New warehouse supply in 2024 totaled 2.6 million sqm, a 30% decline year-on-year but in line with pre-pandemic averages, signaling a shift towards more sustainable growth. The highest volume of new space was delivered in Dolnośląskie (675,000 sqm), followed by Mazowieckie (468,000 sqm) and Łódzkie (343,000 sqm). Major completions included P3 Wrocław (172,800 sqm) and two CTP projects: CTPark Gdańsk Port (119,400 sqm) and CTPark Warsaw West (110,400 sqm).

At year-end, 1.8 million sqm remained under construction, a 38% drop from the previous year, with the highest concentration in Śląskie, Dolnośląskie, and Łódzkie. Speculative developments accounted for 47% of all space under construction, slightly lower than in past years.

Vacancy Rates Remain Stable

The overall vacancy rate stood at 7.5% by the end of 2024, reflecting a marginal 0.1 percentage point increase year-on-year but a 0.5 percentage point drop quarter-on-quarter. The highest vacancy rates were recorded in Lubuskie (19%) and Świętokrzyskie (16.9%), while emerging markets like Podlaskie and Warmińsko-Mazurskie remained nearly fully occupied. Among major markets, Łódzkie (9.7%), Dolnośląskie (9.6%), and Wielkopolskie (7%) had the highest availability.

Rental Rates See Minor Changes

Base rents in 2024 remained stable, with slight increases of up to 5% in some regions. Average rents for big-box facilities ranged from EUR 3.6 to 4.3/sqm/month in older buildings and from EUR 4.0 to 5.5/sqm/month in new developments. The lowest rents were in Łódzkie, Śląskie, and Wielkopolskie (EUR 3.6–3.8/sqm/month), while Warsaw commanded the highest rates, reaching up to EUR 7.25/sqm/month for new projects.

2025 Outlook: Cautious Optimism

Looking ahead, Poland’s industrial and logistics sector is expected to remain one of Europe’s strongest, supported by projected economic growth. Businesses will prioritize process optimization and ESG strategy implementation. Rising costs and labor shortages are likely to encourage increased lease renegotiations. Developers will focus on markets with limited availability, prioritizing projects with a high level of pre-leasing. Stabilization of yields in the investment market is also expected to stimulate further investor activity, including acquisitions of ready-built assets.

Source: AXI IMMO