India’s Residential Mortgage and RMBS Market: An Overview

The securitization of financial assets in India has gained momentum, driven by growing interest from both issuers and investors. As one of the world’s fastest-growing economies, India’s expanding urban population, increasing disposable income, and government incentives continue to support the development of the housing, mortgage, and residential mortgage-backed securities (RMBS) markets.

India, with a population exceeding 1.44 billion and a density of 479 people per square kilometer, has a housing market shaped by economic growth, geographic diversity, and policy interventions. Urban housing primarily consists of apartments and stand-alone homes, while rural areas feature simpler constructions. There is a persistent shortage of affordable housing, although unsold inventory in major cities has been gradually decreasing.

Infrastructure improvements, rising income levels, and urban expansion are expected to sustain growth in the residential property sector. Affordable housing remains in high demand, while the expansion of the upper-middle class is increasing demand for higher-end residential properties. Properties priced under INR 4.5 million to INR 5 million are generally classified as affordable, those between INR 5 million and INR 10 million as mid-segment, and properties exceeding INR 10 million as premium.

Approximately 70% of Indian households own their residences, but in many cases, these homes lack basic amenities or are inadequate for household size. To address housing affordability, the government has introduced various schemes over the years, offering interest subsidies, guarantees for low-income housing loans, and public-private partnerships. The Real Estate (Regulation and Development) Act (RERA), enacted in 2016, aims to enhance transparency and accountability in real estate transactions. However, as its implementation is handled at the state level, progress has been uneven across different regions.

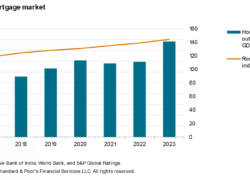

India’s residential mortgage market remains relatively underdeveloped, with mortgage penetration historically ranging between 5% and 9% of nominal GDP. Loans to the household sector account for about 32% of the banking system’s lending, with residential mortgages comprising roughly half of these loans. While banking accessibility has improved since the COVID-19 pandemic, large sections of the population, particularly in rural areas, remain outside the formal lending system.

Commercial banks dominate the residential mortgage market, holding an estimated 70% to 80% market share, followed by non-bank housing finance companies (HFCs). The Reserve Bank of India (RBI) regulates both commercial banks and HFCs, while the National Housing Bank (NHB) supervises HFCs. The banking system is fragmented, comprising public and private sector banks, foreign banks, small finance banks, payment banks, cooperative banks, and regional rural banks.

HFCs operate as a subset of non-bank financial companies (NBFCs) under the Companies Act. Unlike banks, NBFCs are generally restricted from accepting deposits and are not covered by deposit insurance. Since 2019, NHB’s regulatory authority over HFCs has been transferred to RBI, though NHB continues to oversee their supervision and grievance redressal.

Asset reconstruction companies (ARCs) also play a role in India’s financial landscape, purchasing non-performing assets (NPAs) from financial institutions. Regulated by RBI under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI Act) of 2002, ARCs assist in debt resolution through business restructuring, debt restructuring, asset liquidation, or settlements. While ARCs handle various types of NPAs, they are more active in resolving non-personal loans and higher-value personal loans due to economic considerations.

India has four credit bureaus—TransUnion CIBIL, Experian, Equifax, and CRIF High Mark. Since 2015, all scheduled commercial banks, NBFCs, and cooperative banks are required to be members of all credit bureaus, ensuring standardized credit data that is updated regularly. ARCs have also been required to participate in credit bureau reporting since October 2024. These bureaus maintain at least seven years of credit history, tracking borrowers’ credit facilities, overdue payments, loan restructuring, and defaults. Credit scores above 730 are generally considered prime.

A significant factor influencing credit allocation is the priority sector lending requirement set by RBI. Banks are directed to provide credit to specific sectors, including housing, based on factors such as loan size and borrower demographics. For metropolitan areas with populations exceeding one million, priority sector housing loans are capped at INR 3.5 million, provided the total property value does not exceed INR 4.5 million. In non-metro locations, loans up to INR 2.5 million qualify if the overall property value does not exceed INR 3 million.

While these criteria aim to enhance access to housing finance, the rapid appreciation of residential property prices has led to some affordable housing projects exceeding priority sector lending thresholds. As a result, aligning lending policies with evolving market conditions remains an ongoing challenge.

Source: S&P Global