The German economy is showing signs of stabilization after a turbulent start to 2025, though growth this year will remain modest. According to the latest forecast from the German Institute for Economic Research (DIW Berlin), gross domestic product is expected to rise by just 0.2 percent in 2025. Stronger momentum, however, is anticipated from 2026 onward, with growth projected at 1.7 percent and 1.8 percent in the following two years.

Fiscal policy is expected to be the main driver of this recovery. Government spending on infrastructure, climate protection, defense, and incentives for private investment is providing support. However, the international environment remains uncertain. U.S. President Donald Trump’s tariff policy continues to dampen global trade, though a provisional agreement between Washington and Brussels has eased some concerns.

“The federal government has set the course for an upturn,” said DIW Chief Economist Geraldine Dany-Knedlik. “However, the revival of the domestic economy that is now beginning should not obscure the ongoing structural problems. The urgently needed transformation of the ailing industry has not yet taken place. The expansionary fiscal policy is merely concealing the structural problems.”

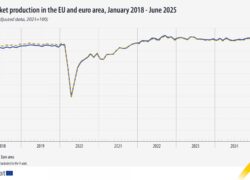

DIW revised its 2025 forecast slightly downward compared with earlier expectations, citing a difficult first half of the year. After a strong start, driven by advance exports ahead of U.S. tariffs, the economy lost momentum. The institute expects the impact of fiscal spending to grow in the coming years, contributing to the anticipated acceleration in 2026 and 2027.

Germany’s growth is increasingly reliant on domestic demand as foreign trade faces headwinds from rising trade barriers. While exports are set to recover somewhat thanks to stronger demand from European partners, Germany’s export-oriented model is under pressure. Private consumption remains a stabilizing factor, supported by real wage growth and lower inflation, although consumer sentiment has been affected by a rise in unemployment and fears of job losses. Public consumption is also projected to expand due to new hiring in the public sector.

DIW President Marcel Fratzscher stressed that long-term recovery depends on structural reforms. “It is still in our own hands to make the German economy fit for the future,” he said. “This requires investment in digitalization and AI, productivity gains, and a reduction in bureaucracy.” He also urged reforms in tax and social security systems, arguing that fiscal policy must focus on reducing subsidies, abolishing tax privileges, and considering higher taxation on large and passive assets, while easing the burden on small and medium incomes.

Globally, economic growth is slowing under the weight of protectionist U.S. trade measures, which have curbed exports and added uncertainty. The euro’s strength is another challenge for the export-oriented eurozone. In China, structural problems in the real estate sector are weighing on global trade. Despite this, expansionary fiscal policies in many countries are offering support, while emerging markets remain the primary growth engines of the world economy.

Overall, the global economy is expected to grow by 3.7 percent in 2025, followed by 3.3 percent in 2026 and 3.5 percent in 2027.

Source: DIW Berlin