The global natural gas market displayed contrasting trends in the third quarter of 2025, as regional conditions, supply dynamics and consumption patterns shifted in different directions. While Europe enjoyed relative stability thanks to strong imports and high storage levels, the United States experienced renewed price pressure driven by robust production and record export volumes. Across Asia, demand weakened slightly as industrial activity slowed and alternative energy sources gained ground.

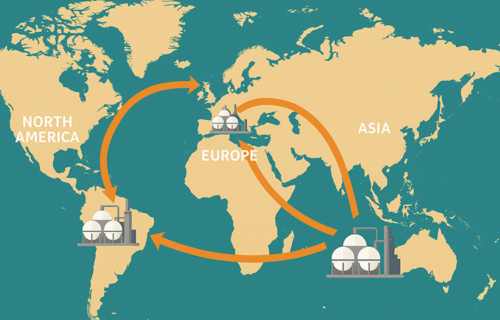

In Europe, steady shipments of liquefied natural gas combined with resilient Norwegian production helped to calm prices after the volatility of previous years. Consumption across the European Union rose moderately during the first eight months of 2025, though it eased in late summer due to increased renewable generation and weaker industrial use. Storage levels reached more than 80 percent of capacity by early October, providing a comfortable buffer ahead of winter. Russian gas flows continued to decline sharply, but this was offset by a surge in imports from the United States, highlighting Europe’s accelerated shift away from traditional supply routes. To strengthen its energy security framework, the EU extended its storage policy through 2027 and allowed more flexible timing for when members must meet seasonal targets.

In Asia, the picture was more subdued. China’s LNG imports fell noticeably compared with the same period last year, reflecting a combination of high inventories and slower industrial demand. Japan and South Korea also registered slightly lower gas use as utilities relied more on coal and renewable energy. The region’s overall LNG imports slipped modestly compared with 2024, although analysts expect China’s consumption to pick up again in the coming year as new gas-fired power plants come online and transport demand rises.

The United States, meanwhile, continued to expand its dominance on the supply side. Output from major shale regions increased steadily throughout the year, underpinned by new infrastructure and sustained investment. Export capacity also climbed, with large-scale terminals in Louisiana and Texas playing a central role in meeting the energy needs of Europe and Asia. These projects have reinforced America’s position as a cornerstone of global gas supply at a time when demand for secure and flexible sourcing remains strong.

In the Middle East, producers are pursuing major expansion plans designed to lift the region’s profile in the coming decade. New projects across Qatar, the United Arab Emirates, Saudi Arabia and Oman are expected to boost the region’s combined gas production by nearly one-third by 2030. Billions of dollars in contracts have been awarded this year to expand extraction, processing and export facilities, including Qatar’s North Field expansion and ADNOC’s large-scale gas development programme in the UAE. These investments are intended to ensure long-term production capacity and maintain the region’s competitiveness as global demand evolves.

Looking ahead, overall gas consumption worldwide is forecast to grow at a slower pace in 2025, as high prices, efficiency measures and milder weather temper demand in key markets. Nonetheless, expanding production in North America and the Gulf is expected to underpin global supply stability. While ongoing geopolitical tensions in Eastern Europe and the Middle East continue to pose risks to trade routes and market sentiment, Europe’s improved storage position and diversified supply sources suggest a system more resilient than in past years.

Source: Kamco Invest