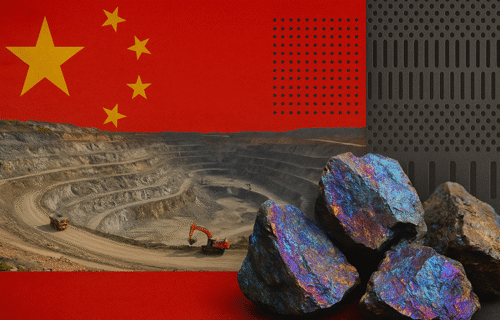

China’s latest decision to tighten controls over exports of rare earths and battery materials is being widely viewed as a strategic move that reaches far beyond resource management. Analysts across Europe and the United States say the measures are designed to reinforce Beijing’s influence in high-tech supply chains, safeguard its industrial expertise, and remind the West of its continued dependence on Chinese materials.

The new controls, unveiled in early October, expand government oversight to cover both the export of raw materials and the transfer of the technologies used to produce and refine them. Some provisions will even apply to goods manufactured abroad if they contain Chinese-origin inputs or rely on Chinese processes, giving the rules global reach. They come into force between November and December 2025.

Experts at several think tanks describe the move as part of a broader contest over economic power. With many countries restricting exports of semiconductors and advanced machinery to China, Beijing is now leveraging its dominance in critical minerals such as rare earths, lithium and graphite—materials essential to electric vehicles, electronics and defence industries.

“The message is clear: China still holds vital cards in global manufacturing,” one European analyst said. “This is economic diplomacy through supply chains.”

The rules also cover technologies used in rare-earth mining and magnet production, reflecting a push to keep advanced know-how within China. Observers see this as an effort to move up the value chain by limiting what foreign companies can access, while encouraging domestic firms to produce higher-value finished goods rather than exporting raw materials.

A research fellow at a Berlin-based policy institute noted that “China is moving from being the world’s workshop to becoming the world’s gatekeeper.”

The timing of the announcement, coming just ahead of renewed trade and security talks with Western partners, has drawn attention. Analysts believe Beijing is signalling that it can respond to foreign export bans—particularly those on chips and artificial intelligence systems—with restrictions of its own. Some describe the move as a way to gain leverage without direct confrontation.

Industry groups warn that the controls could complicate supply chains for electric vehicles, aerospace and defence manufacturers worldwide. Businesses are expected to conduct detailed reviews of their sourcing and production processes to assess whether they fall under the new rules.

At the same time, several governments are accelerating efforts to develop alternative suppliers in Australia, Africa and North America, hoping to reduce long-term reliance on China.

Officially, Chinese authorities say the new framework is meant to prevent misuse of strategic resources and protect national security. Yet outside observers see a clear strategic layer: a demonstration that, even as the West seeks to “de-risk” from China, Beijing retains the power to shape the global economy through selective access to materials the world cannot easily replace.

For now, the move reinforces an uncomfortable truth for many countries — that clean-energy transition and technological progress still rely heavily on resources under Chinese control.