The 2024 European Purpose-Built Student Accommodation (PBSA) Investment Barometer, conducted by The Class Foundation and Savills, reveals significant growth prospects for the sector. Surveying investors and operators managing over 132,000 beds across Europe with an asset value of approximately €25.3 billion, the report highlights plans to increase bed numbers by 70% within the next 2-5 years. This expansion would add over 220,000 beds, backed by €22 billion in additional capital investment.

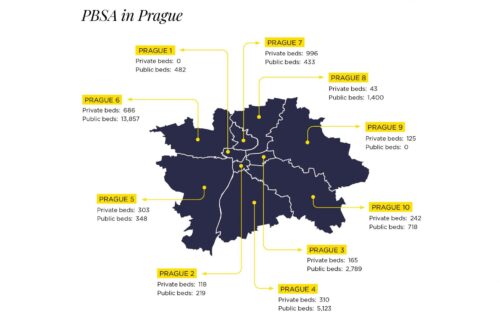

Despite high demand for student accommodation in Prague, the city struggles with a critical undersupply of PBSA stock. According to Fraser Watson, Head of Investment at Savills Czech Republic & Slovakia, Prague’s existing PBSA capacity stands at just 28,550 beds—insufficient to meet the needs of the growing student population.

“Investing in PBSA in Prague is a compelling opportunity,” Watson noted. “The city benefits from stable demand, a pronounced shortage of accommodation, and the economic reality that most students cannot afford private apartments outside of the student housing sector.”

Prague’s PBSA market is predominantly controlled by universities, which own 90% of the total capacity. However, the standard of living in university dormitories often falls short when compared to private PBSA offerings. Currently, Prague hosts 22 private student residences with a combined capacity of nearly 3,000 beds. Including co-living schemes popular among students, this figure rises to 3,800 beds. Significant private operators include The FIZZ, Comenius, DC Residence, and Zeitraum U Průhonu.

Prague’s universities attract a large student population, creating significant accommodation challenges:

• Czech Nationals: Of the 117,600 Czech university students in Prague, 71,200 commute from outside the city, while the remaining 46,400 are likely to seek local accommodation.

• International Students: An additional 27,660 international students are enrolled in Prague’s universities annually.

Together, these groups represent nearly 75,000 students vying for accommodation each year, far exceeding the city’s PBSA capacity. This shortfall spills over into the private rental sector, driving up demand and costs.

As the PBSA market evolves, investors face a dynamic mix of opportunities and challenges. According to Richard Valentine-Selsey, Head of European Living Research & Consultancy at Savills, the sector’s success will hinge on navigating economic conditions, adapting to shifting student demographics, and prioritizing environmental sustainability.

“Decisions made now regarding new developments, financing, and adherence to ESG principles will have lasting impacts across the sector,” Valentine-Selsey emphasized.

With demand for student accommodation in Prague vastly outstripping supply, the city presents a prime opportunity for PBSA investment and development. As investors deploy capital to address the shortage, integrating sustainable practices and innovative solutions will be key to shaping the future of student living in Prague and across Europe.