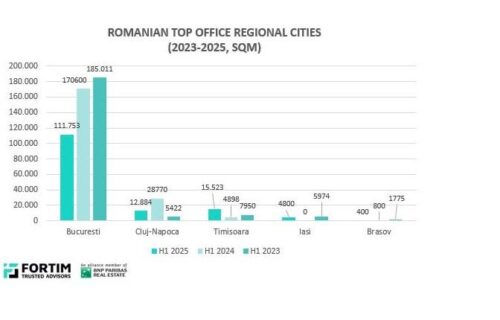

At the national level, in the five major cities with developed office markets – Bucharest, Timisoara, Cluj-Napoca, Iasi, and Brasov – the total volume of leased office space in the first six months of the year was 145,360 square meters, down by 29.2% compared to the same period in 2024.

The capital remains the most important office market in Romania, but it also recorded the sharpest decline in demand. In the first six months of 2025, 111,753 square meters of office space were leased in Bucharest, representing 76.8% of the total transactions carried out in the country’s main business hubs, according to a report by Fortim Trusted Advisors, an alliance member of the BNP Paribas Real Estate.

“Timișoara is the only business hub where demand for office space increased in the first six months of this year compared to the same period in previous years. In the other major cities, including Bucharest, we’re seeing a decrease in leased spaces, amid political uncertainties in the first part of the year and the suspension of new office building deliveries. However, we expect leasing activity to recover in the second half of the year, with the announced deliveries of new spaces scheduled to begin at the end of 2025 and continue through 2027,” said Nicolae Ciobanu, Managing Partner – Head of Advisory at Fortim Trusted Advisors, an alliance member of the BNP Paribas Real Estate.

The biggest office market transaction in Romania during the first six months of the year was recorded in Bucharest, where BCR renewed its lease agreement for a space of 22,300 square meters in The Bridge building, located in the Orhideea–Grozăvești area.

In secondary cities, the most significant transaction was made by Vertiv Romania, which extended its lease for a 4,667-square-meter space in the Advancity Business Center in Cluj-Napoca.

As for new company relocations, the largest leased spaces in 2025 include 4,000 square meters occupied by Leroy Merlin in Floreasca Park in Bucharest and 3,000 square meters leased by Continental in Timișoara.

There is a noticeable gap between the areas associated with lease renegotiations and those involving new lease contracts, with renegotiations holding the upper hand—an indication that many companies prefer to consolidate their presence in existing locations given the current market context.