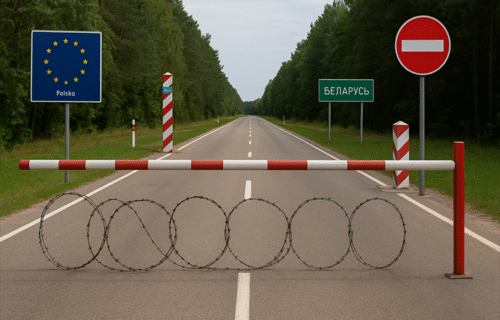

Warsaw’s decision in mid-September 2025 to shut all road and rail crossings with Belarus during the Russia-Belarus “Zapad-2025” drills has immediate security and economic implications. The Interior Ministry’s regulation, which took effect from September 12 with no fixed end date, suspends passenger and freight movement to mitigate risks from potential incidents and airspace violations linked to the exercises.

The closure affects a critical section of the Eurasian land bridge. Poland is the dominant EU gateway for China–Europe rail freight, and the Małaszewicze reloading region at the Belarus border is the principal transshipment hub on this route. In 2024, Małaszewicze handled roughly 84.7% of westbound China–Europe rail cargo (around 280,200 TEUs), underscoring how disruptions here reverberate across European supply chains. Even before the current shutdown, operators reported periodic bottlenecks and queueing at this crossing.

The stoppage is already producing practical consequences: thousands of vehicles were caught on the Belarusian side when the closure took effect, while Polish authorities advised hauliers to reroute. Prolonged suspension would likely push more Asia-Europe volumes to sea and air, raising transit times and costs for shippers that rely on time-sensitive rail.

Diplomatically, Beijing has engaged. Chinese Foreign Minister Wang Yi met Polish Deputy PM and Foreign Minister Radosław Sikorski in Warsaw on September 15 during the Poland–China Intergovernmental Committee, a forum both sides used to signal the importance of stable trade corridors. For China—balancing ties with Moscow and commercial interests in Europe—predictable transit through Poland is strategically valuable.

Broader trade politics add pressure. In parallel, U.S. President Donald Trump urged NATO states to impose 50–100% tariffs on Chinese goods to curb revenues linked to Russia; Washington has hinted at further measures depending on Europe’s response. Escalation on this front would raise the cost of Chinese exports, further elevating the value of efficient, low-risk logistics paths into the EU—again putting a premium on the reliability of the Polish corridor.

Bottom line: Poland’s security-driven border closure is also a supply-chain event. Because so much China–EU rail freight funnels through Małaszewicze, even temporary suspensions ripple into lead-times and costs for European industries. With Beijing engaging Warsaw and tariff talk intensifying in Washington, the intersection of security and trade policy is unmistakable: restoring predictable operations at Poland’s eastern border is now a shared interest for the EU, China-based exporters, and multinational shippers.

Source: WEI (Warsaw Enterprise Institute)