Over the past five years, IT companies, manufacturing and industrial firms, and the medical and pharmaceutical sectors have been the most active in Romania’s office leasing market. According to Cushman & Wakefield Echinox, these industries accounted for more than half of the new office space demand across major cities.

Between 2020 and 2024, net take-up in Bucharest, Cluj-Napoca, Timișoara, Iași, and Brașov totaled approximately 1.06 million square meters. This figure is equivalent to the total office stock in the four regional cities combined or about 30% of Bucharest’s total office supply. Given an average office space allocation of 8-10 square meters per employee, the newly leased spaces could accommodate at least 100,000 employees.

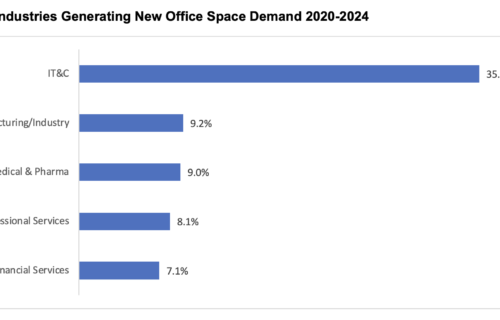

The IT sector remained the main driver of demand, accounting for over 35% of new leases, or approximately 375,730 square meters. With a nearly 7% contribution to Romania’s GDP in 2024, the sector has remained a key force in the office market. Manufacturing and industrial companies followed, leasing about 98,000 square meters, representing 9.2% of total volume. The pharmaceutical and medical sectors secured 95,200 square meters, making up 9% of total demand. Professional services firms leased nearly 86,000 square meters, while the financial sector, including banks and insurance companies, contracted over 75,000 square meters.

Total office space transactions, including renegotiations, exceeded 2 million square meters over the period, with IT firms accounting for more than 40% of the total volume.

The current stock of modern office space in Bucharest and the major regional university cities stands at approximately 4.51 million square meters. Another 390,000 square meters are under development and scheduled for completion in the next five years. The overall vacancy rate across these five cities is 13.8%, with Cluj-Napoca recording the lowest at 6.6% and Iași the highest at 19.4%. In Bucharest, the vacancy rate declined to 14.2% by the end of 2024.

Prime office rents in Bucharest reached €21 per square meter per month by the end of last year, marking a 10.5% increase since 2020. In regional cities, rental growth reached up to 13%, with maximum rates of €17 per square meter per month.

Mădălina Cojocaru, Partner in the Office Agency at Cushman & Wakefield Echinox, noted that IT companies continue to shape the office leasing market, despite some adjustments in space requirements. She highlighted the sector’s steady expansion and its role in driving real estate demand. The limited availability of office spaces in central Bucharest, coupled with sustained demand, points to the need for new developments in well-connected areas. She cited Calea Buzești as an emerging business hub, benefiting from ongoing urban redevelopment.

Source: Cushman & Wakefield Echinox Research