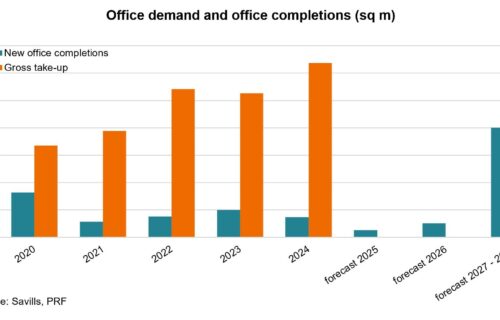

The demand for office space in Prague reached an unprecedented level in 2024, with companies seeking a total of 637,000 square meters. However, only 24,600 square meters of new office space is expected to be delivered in 2025, exacerbating the existing supply shortage. Analysis by Savills indicates that office development in Prague has been in steady decline since 2021, with just 72,800 square meters of office space completed in 2024. This ongoing reduction in supply has created a significant imbalance in the market.

Before 2020, annual office development in Prague averaged 150,000 square meters, but has since declined by more than 50%. Currently, around 164,000 square meters of office space is under construction across the city, but much of this has already been secured. Approximately 60% of the new space is pre-leased, with an additional 25% reserved, leaving less than 15% available for new tenants. The most pronounced shortages are in prime locations, including Prague’s city center and Karlín, where modern office occupancy rates exceed 95%, according to Pavel Novák, Head of Office Agency at Savills.

Larger office projects are not expected to enter the Prague market before 2027 to 2029. Novák notes that while several projects are in advanced planning stages, no substantial increase in supply is anticipated over the next two to three years. Companies planning future expansions have the opportunity to assess these upcoming projects now, securing key details and gaining early access to available spaces. Additionally, extensive experience among local developers, architects, and construction firms will likely contribute to the quality of these new office developments.

One of the primary reasons for the decline in new office construction is the lengthy and complex permitting process in the Czech Republic. In some cases, project approvals can take ten years or longer, during which time costs continue to rise. Increased expenses for labor, materials, and energy further contribute to higher development costs. Although interest rates have declined, they remain elevated compared to previous levels, adding to financial pressures. These cost increases translate into higher rental prices, which must align with market expectations to ensure project viability. Prague’s competitiveness is also affected by faster approval processes in neighboring Central European countries such as Poland.

The persistent demand for premium office space in the city center, combined with construction cost increases, has led to further rental price growth. By the end of 2024, headline rents for modern office spaces in central Prague ranged from €28.50 to €29.50 per square meter per month, reflecting a 7% year-on-year increase. In other districts of Prague, headline rents have risen by an average of 4% over the past year, reaching €18.50 to €19.50 per square meter per month.

The market is also experiencing the effects of deferred demand, where companies unable to secure office spaces with required specifications choose to extend their existing leases instead. This delay in decision-making could lead to additional market pressure once new office spaces become available, further shaping the office sector in the coming years, according to Novák. The Prague office market is now at a critical juncture, with demand continuing to outstrip supply and development constraints limiting future expansion.

Source: Savills Czech Republic