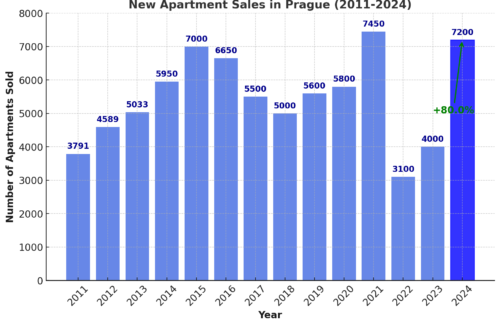

The Prague real estate market saw unprecedented demand for new apartments in 2024, with 7,200 units sold, marking an 80% year-on-year increase. This surge, driven by lower mortgage rates, has outstripped supply, pushing prices up by 7%, according to a market analysis published by Central Group, Skanska Residential, and Trigema.

Near-Record Sales Despite Supply Stagnation

In the final quarter of 2024 alone, 1,850 apartments were sold, bringing annual sales close to 2021’s record of 7,450 units. This trend mirrors the mortgage market, where new loan volumes surged by 83% over the previous year.

“The demand for real estate as a secure investment with consistently rising value remains strong, and I expect it to continue this year,” said Marcel Soural, Chairman of Trigema Investment Group.

Prices Climb Faster Than Expected

By year-end, the average listing price for new apartments in Prague reached CZK 163,203/m², a 7% annual increase, while sales prices jumped 10% to CZK 156,851/m², both hitting new record highs. The Czech National Bank (CNB) had previously warned that supply constraints could drive prices even higher, and the current market conditions suggest continued growth of 5-10% this year.

• Most affordable districts: Prague 9 and 10, where prices hover around CZK 149,000/m².

• Most expensive districts: Prague 1, 2, and 7, where prices exceed CZK 200,000/m².

• Fastest growth: Prague 3, with a 21% annual increase.

“The rise in prices was driven by new premium projects, reductions in promotional discounts, and rising construction costs,” explained Petr Michálek, Chairman of Skanska Residential. “However, the biggest issue remains Prague’s long-standing approval delays, which keep supply far below demand.”

Persistent Supply Deficit Threatens Further Price Increases

At the end of 2024, only 5,700 new apartments were available in Prague—a stagnant figure for the past two years. While more units entered the market than in previous years, this failed to meet demand, as most were delayed projects launched when market conditions improved.

The slow approval process remains a major bottleneck. Prague approved just 6,340 new flats from January to November 2024, far below the 10,000 units needed annually. Meanwhile, an increasing share of new developments is being absorbed by the growing rental market, further tightening supply.

“The lack of new housing approvals has made apartments at least 15% more expensive,” said Dušan Kunovský, Chairman of Central Group. “This is costing the state tens of billions in lost taxes and fees, making housing even more unaffordable. It’s baffling that this issue hasn’t been resolved for so long.”

With mortgage rates expected to fall further in 2025, demand could reach record highs, intensifying Prague’s housing shortage and driving prices even higher.

Source: Central Group, Skanska Residential and Trigema