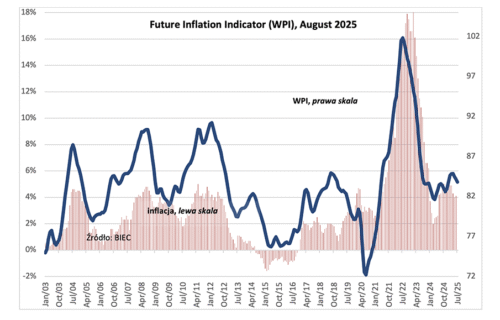

The Future Inflation Index (WPI), which anticipates changes in consumer prices several months ahead, declined by 0.4 points in August 2025 from the previous month. This marks the fourth monthly drop in a row, with the decrease similar in scale to recent declines. Short-term global and domestic factors are currently slowing the pace of price growth and the main measure of inflation, the Consumer Price Index (CPI). However, longer-term risks remain.

External risks include ongoing armed conflicts worldwide and the unstable trade policy of the US administration, both of which influence global commodity prices. Domestically, challenges include rapidly rising public debt, the absence of a consistent energy policy, wage growth significantly outpacing inflation, and sharp increases in food and service prices.

The largest downward pressure on the index comes from declining inflation expectations among consumers and manufacturing sector representatives. In July, the share of consumers expecting prices to rise at least as fast as before fell by 2 percentage points from the previous month and by 5 points year-on-year. The group anticipating faster price growth has halved over the past year, from 22% to 11%.

In manufacturing, the share of companies expecting price increases over those planning reductions has dropped from 13.3% in January to 2.6% in July. This trend varies by industry, with the energy sector seeing notable price decreases and the food processing sector still expecting increases. In the services sector, companies planning price hikes continue to dominate, particularly in tourism, hotels and catering, insurance, real estate, and financial services, where the share ranges from 12% to nearly 18%.

On global markets, raw material prices have been declining since the start of the year, though recent days have brought higher oil, gas, and some metal prices. The appreciation of the Polish zloty against the US dollar has partly offset the impact of more expensive imports for domestic producers.

Industrial capacity utilisation in Poland stood at about 77% in July, unchanged from April, a level consistent with moderate economic growth. Historically, utilisation ranges from around 70% in downturns to 83% in peak periods. However, underinvestment in the private sector could lead to higher machinery failure rates and increased repair costs in the future.

Source: BIEC