In August 2025, plug-in hybrid electric vehicles (PHEVs) overtook battery electric vehicles (BEVs) in the domestic passenger car market, according to the Association of Automobile Importers. While BEV registrations rose year-on-year from 781 to 840 units, PHEVs surged from just 47 in August 2024 to 948—a near twentyfold increase. As a result, PHEVs accounted for over five percent of new car registrations in August, while BEVs remained below that threshold.

Despite the August turnaround, BEVs maintain the upper hand for the year to date. By August 2025, EV registrations totaled approximately 8,800 units, versus around 6,800 for PHEVs. Škoda leads the PHEV segment with 1,310 units sold so far, followed by Hyundai, Toyota, Volkswagen, and Volvo, each with sales exceeding 500 units.

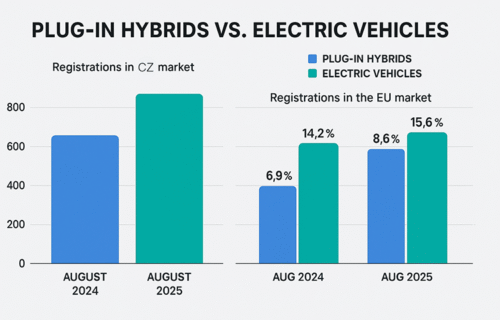

These domestic figures mirror broader European trends: From January to July 2025, PHEVs captured 8.6 percent of the EU market, up from 6.9 percent in 2024. BEVs held a larger share at 15.6 percent . Hybrid-electric vehicles (HEVs), which include non-plug-in hybrids, remained the most popular choice among EU consumers, commanding 34.7 percent of the market .

Historically, the EU has seen strong momentum in electrified vehicles. Hybrid and plug-in models continue to climb, while petrol and diesel car registrations have declined sharply—falling to under 38 percent combined, down from about 48 percent in the previous year . The rapid rise of EV sales has been notable too: over one million BEVs were registered across Europe by July, capturing a 15.6 percent share of the market .

In summary, while PHEVs dominated Polish dealerships in August—a reflection of shorter-term demand shifts—BEVs continue to show stronger cumulative growth, consistent with European patterns of gradual electrification. The marketplace remains fluid, with hybrids and fully electric models each playing a significant role in the transition.