The London office market experienced a notable resurgence in the latest quarter, with leasing activity reaching 2.87 million sq ft, marking a 30.45% increase quarter-on-quarter. This significant growth reflects a rebound in occupier demand, particularly for high-quality Grade A spaces. However, despite the uptick in activity, the figure remains 4.33% below the 10-year quarterly average of 3.0 million sq ft, underscoring the lingering impact of macroeconomic uncertainty and hybrid working patterns.

A key factor behind this leasing revival is the sustained flight to quality, as businesses continue to prioritize modern, sustainable, and well-located office spaces. Both the City and West End submarkets remain at the forefront of this trend, with occupiers seeking premium office environments that align with ESG commitments and evolving workplace expectations.

While challenges such as hybrid work models and stricter EPC (Energy Performance Certificate) regulations persist, a tightening supply of newly built and refurbished spaces has supported rental growth. This supply-demand imbalance, coupled with growing investor confidence, is fostering a cautiously optimistic outlook for 2025.

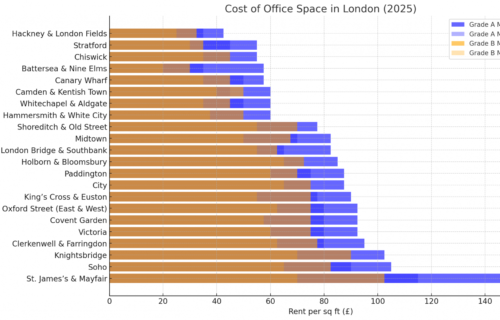

The limited availability of best-in-class office spaces has driven further increases in London’s prime office rents, with the West End core reaching £150 per sq ft—a new benchmark for the area. Other key submarkets also recorded growth, with the City at £85 per sq ft, while Shoreditch and Victoria saw their rental rates rise in response to demand.

By the end of 2024, prime rents across London continued their upward trajectory, supported by sustained occupier demand and a lack of premium stock. In the City core, prime rents edged up to £87.50 per sq ft, while Farringdon and Midtown recorded £95 per sq ft and £80 per sq ft, respectively.

These trends illustrate the emergence of a two-tier market, where demand for sustainable, high-quality spaces continues to drive rental appreciation, while lower-grade stock faces increasing pressure to modernize and align with evolving occupier preferences. As businesses place greater emphasis on ESG credentials and premium amenities, landlords of secondary office spaces must consider significant refurbishments or risk prolonged vacancies.

The financial sector emerged as the dominant force in London’s office market, accounting for 31% of total take-up in the most recent quarter. This was bolstered by major transactions such as Legal & General’s pre-let of 186,648 sq ft at Woolgate, EC2, demonstrating the industry’s ongoing commitment to securing prime, sustainable office locations.

The professional services sector followed closely, contributing 29% of total take-up. A standout transaction in this segment was BDO LLP’s 218,496 sq ft lease at The M Building, which marked the largest-ever letting in Marylebone and reinforced the sector’s preference for high-quality, centrally located developments.

The Technology, Media, and Telecommunications (TMT) sector remained a key driver of demand, accounting for 15% of overall leasing activity. Meanwhile, the public sector maintained its steady presence in the market, representing 8% of total take-up.

As London’s office market enters 2025, the flight to quality will continue to shape demand, with occupiers favoring buildings that offer top-tier sustainability credentials, premium amenities, and strategic locations. While challenges such as rising operating costs, regulatory pressures, and evolving workplace dynamics remain, the market is expected to maintain strong momentum, particularly in the prime and newly developed office segments.

With a tightening supply of premium office stock and increasing rental growth in core submarkets, landlords and investors who adapt to shifting occupier preferences will be best positioned to capitalize on London’s evolving commercial real estate landscape.

Source: oktra