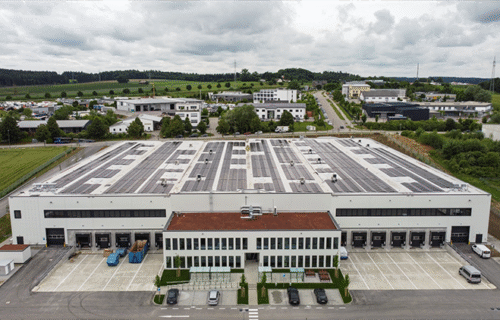

HIH Invest Real Estate has strengthened its logistics portfolio with the purchase of a newly completed property in Pfaffenhofen an der Ilm, Bavaria, for its HIH Deutschland+ Core Logistik Invest fund. The 12,500-square-metre facility, developed by the Intaurus Group, was finalised in June 2025 and is fully leased to New Flag GmbH, a Munich-based international distributor of hair and beauty products. The purchase price remains confidential.

Located in the Kuglhof industrial park at Schäfflerstraße 14, the site benefits from direct access to the A9 motorway and lies roughly 40 kilometres from Munich Airport. The building comprises 10,200 square metres of warehouse space, 1,330 square metres of mezzanine, and 910 square metres of office and social areas, complemented by 57 parking spaces. New Flag GmbH has signed a ten-year lease with an option to extend.

Designed to meet DGNB Gold Standard sustainability criteria, the property features a photovoltaic system and a heat pump for energy efficiency. Its modular design allows for flexible future use, with the potential to divide the premises into two independent units.

“Pfaffenhofen is an ideal logistics location,” said Maximilian Tappert, Head of Transaction Management Logistics at HIH Invest. “Its proximity to Munich and Ingolstadt, coupled with competitive rental levels, makes it especially appealing to companies in e-commerce, pharmaceuticals, and industry.”

Andreas Strey, Co-Head of Fund Management and Head of Logistics at HIH Invest, emphasised the long-term stability of the investment: “The combination of a prime location in southern Germany and sustainable construction standards ensures strong tenant appeal and reliable income for our investors.”

Representing the seller, Oliver Raigel, Managing Director of Intaurus Group, highlighted the partnership: “We are pleased to have delivered a state-of-the-art logistics property that aligns with modern ESG requirements. Our collaboration with HIH Invest was built on trust and professionalism.”

This acquisition marks the eighth addition to the HIH Deutschland+ Core Logistik Invest fund, which now holds assets in both Germany and the Netherlands. The vehicle targets a portfolio volume of at least €300 million, focusing on modern core logistics assets with strong third-party usability and high sustainability standards. Around 70% of the fund’s capital is allocated to Germany, with the remainder invested in neighbouring markets including the Netherlands, France, and Austria.

Due diligence for the transaction was conducted by Baker Tilly (legal and tax) and JT Solutions (technical and ESG), while Realogis acted as broker. The Intaurus Group received legal advice from Glock Liphart Probst & Partner.