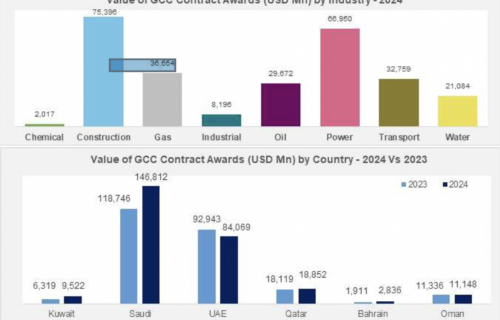

The Gulf Cooperation Council (GCC) projects market surged to new heights in 2024, reaching a record USD 273.2 billion in awarded contracts, marking a 9.6% year-on-year increase. The robust growth was primarily fueled by Saudi Arabia’s aggressive expansion in the energy sector, particularly renewables, alongside strong infrastructure investments across the region.

Saudi Arabia Leads with Renewable Energy and Infrastructure Megaprojects

Saudi Arabia continued to dominate the GCC projects market, accounting for USD 146.8 billion, representing 53.8% of the total projects awarded in the region. The kingdom’s commitment to Vision 2030 played a crucial role in driving investments, particularly in renewable energy, with 25 projects generating approximately 23 gigawatts of electricity signed in 2024.

The power sector overtook construction as the largest in terms of awarded projects, with contracts in the sector more than doubling to USD 55.0 billion, up from USD 25.0 billion in 2023. Similarly, the gas sector nearly doubled, reaching USD 19.1 billion, reflecting a substantial push toward energy diversification. However, construction sector projects declined by 10.6%, totaling USD 28.4 billion.

Notably, seven of the ten largest GCC projects in 2024, each exceeding USD 2 billion, were awarded in Saudi Arabia. These included the USD 4.7 billion NEOM Trojena Valley Cluster Dam project and the USD 3.73 billion high-voltage transmission line project connecting key industrial regions.

UAE Sees Decline in Contract Awards Despite Large-Scale Developments

Despite maintaining its position as the second-largest projects market in the GCC, the UAE experienced a 9.5% decline in awarded contracts, totaling USD 84.1 billion, down from USD 92.9 billion in 2023. The decrease was driven by a sharp 54.7% drop in gas sector contracts, which fell to USD 8.8 billion from USD 19.4 billion in 2023.

However, the construction sector remained dominant, accounting for 47.5% of total project awards, reaching USD 40.0 billion. The UAE also saw major transport investments, with Dubai Metro’s USD 5.6 billion Blue Line project and the USD 5.5 billion Ruwais Low Carbon LNG Terminal ranking as the largest two projects in the GCC in 2024.

Kuwait Achieves Highest Growth in Contract Awards

Kuwait recorded the highest percentage growth in the GCC, with a 50.7% year-on-year increase in awarded contracts, reaching USD 9.5 billion. The growth was largely driven by infrastructure investments under Vision 2035, particularly in the construction sector, which saw an over sixfold increase to USD 4.0 billion.

Key projects included the USD 142 million Kuwait substation contract and the USD 146 million maintenance works project in Mubarak Al-Kabeer Governorate.

Qatar’s Oil Sector Drives Growth Amid Decline in Gas Projects

Qatar saw a moderate 4.5% growth in contract awards, reaching USD 18.9 billion in 2024. The country’s oil sector experienced a nearly eightfold increase, totaling USD 6.3 billion, accounting for 33.5% of total awarded contracts. However, the gas sector—historically dominant—saw a sharp decline of 49.5%, dropping to USD 6.0 billion.

Two of the top 20 GCC projects were awarded in Qatar, including the USD 4.0 billion QatarEnergy LNG – North Field Production Sustainability Phase 2 and the USD 2.1 billion Al Shaheen Oil Field Development project.

Outlook for 2025: Continued Growth with Strong Pipeline of Projects

The GCC projects market is expected to maintain its momentum in 2025, with over USD 120 billion worth of projects already in bid evaluation. Saudi Arabia is projected to lead, driven by its NEOM giga projects and energy initiatives.

While oil price stability and interest rate reductions are expected to support further investment, concerns remain over global supply chain disruptions and OPEC+ production limits. Nonetheless, approximately USD 1.5 trillion worth of projects remain in the pre-execution stage, with Saudi Arabia holding the largest share at USD 770.5 billion.

Major projects expected in 2025 include:

• USD 5.0 billion Taziz Industrial Chemicals Zone – Phase II

• USD 3.7 billion National Grid Battery Energy Storage Systems

• USD 3.0 billion Taweelah C Combined Cycle Gas Turbine IPP

The GCC’s industrial, utilities, and technology sectors are expected to witness significant investment, particularly with increased focus on AI-driven projects and data centers.

The region’s commitment to sustainability and economic diversification will continue to shape its infrastructure and energy landscape, positioning the GCC as a global leader in megaproject development.