The GCC stock markets saw a mixed performance in February 2025, with three of the seven regional exchanges posting gains despite the overall decline in the MSCI GCC index. The market downturn was largely influenced by a global economic slowdown, geopolitical tensions, and declining crude oil prices.

Market Performance Overview

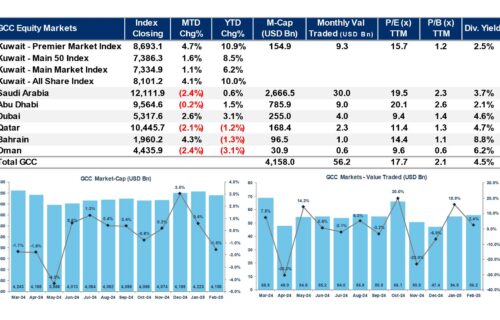

The MSCI GCC index dropped by 0.4% in February, primarily due to losses in large-cap stocks. The best-performing markets were Bahrain (+4.3%), Kuwait (+4.1%), and Dubai (+2.6%), while Saudi Arabia (-2.4%), Oman (-2.4%), and Qatar (-2.1%) registered declines. Abu Dhabi posted a marginal 0.2% loss.

Despite February’s downturn, the year-to-date (YTD) performance of the GCC markets remained positive, with a 2.6% gain overall. Kuwait led the region with an impressive 10% increase since the start of 2025.

Sectoral Performance

The Real Estate sector outperformed other industries with a 2.5% gain, followed by Telecommunications (+2.0%) and Banks (+1.9%). In contrast, the Insurance, Healthcare, and Utilities sectors faced mid-single-digit declines, while the Materials and Energy sectors dropped by 5.1% and 1.7%, respectively.

Country-Specific Highlights

Kuwait: Market Continues Strong Growth

Kuwait’s Premier Market Index led the gains, rising 4.7% to 8,693.1 points. The All-Share Market Index broke the 8,000-point mark, closing at 8,101.2 points (+4.1%). Trading volume surged 47.1%, reaching its highest monthly level since June 2009.

Saudi Arabia: Index Faces Decline Amid Oil Price Volatility

Saudi Arabia’s TASI index fell 2.4% in February, closing at 12,111.9 points. This decline was attributed to weak earnings reports and falling crude oil prices. The Media sector was the worst performer, down 19%, while Telecommunications and Banking sectors gained 4.6% and 0.7%, respectively.

UAE: Mixed Results for Abu Dhabi and Dubai

Abu Dhabi’s ADX saw a slight 0.2% drop, but its Real Estate sector recorded a strong 15.5% gain.

Dubai’s DFM gained 2.6%, driven by strong performances in the Financial and Real Estate sectors. Emirates Islamic Bank was the top gainer with a 25.7% share price increase.

Qatar: Broad-Based Declines

The QE 20 index fell 2.1%, while the broader QE All Share Index managed a 0.1% increase. The Real Estate sector was the worst performer (-3.3%), while the Transportation sector was the best (+3.3%).

Bahrain: Strongest Market in February

Bahrain’s All Share Index jumped 4.3%, making it the top-performing market in the GCC. The Real Estate sector led with a 10.4% gain, driven by Seef Properties (+13%).

Oman: Continued Weakness

Oman’s MSX 30 index dropped 2.4%, extending its losses from January. The Financial and Services sectors posted declines, while the Industrial sector surged 7.8%. Oman’s first IPO of 2025, Asyad Shipping, is expected to raise OMR 128.1 million.

Outlook for GCC Markets

Despite February’s volatility, GCC markets remain in a strong position due to economic diversification efforts, stable corporate earnings, and positive investor sentiment. Kuwait’s robust growth, the UAE’s economic resilience, and strong performances in Bahrain and Dubai indicate that market confidence is holding firm. However, ongoing geopolitical uncertainties and fluctuating oil prices may continue to impact regional markets in the months ahead.

Source: GCC Markets Monthly Report, Kamco Invest Research