The GCC Inflation Report 2024 by Kamco Invest highlights a year of moderate inflation across the Gulf Cooperation Council (GCC) nations. While global inflation continued to ease, the GCC maintained lower inflation levels compared to other emerging markets, thanks to government policies such as energy price caps, subsidies, and currency pegs. However, inflation in the housing sector remained a challenge in several GCC countries.

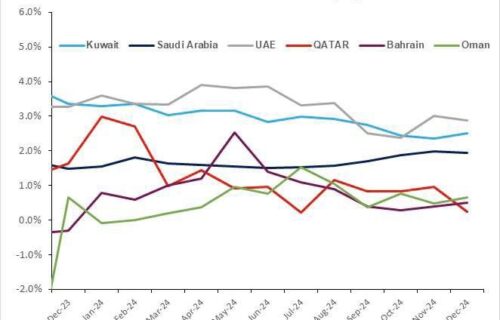

The World Bank estimated the region’s inflation rate at 2.1% in 2024, significantly lower than in other global markets. Government interventions helped contain price increases, with some countries seeing inflation decline. Dubai recorded an annual inflation rate of 3.3%, remaining stable compared to 2023. Kuwait’s inflation dropped from 3.4% to 2.5%, while Saudi Arabia saw a slight increase from 1.5% to 1.9%.

On a global scale, inflation trends showed improvement. The International Monetary Fund projected global inflation to decline to 4.2% in 2025 and 3.5% in 2026. The United States saw inflation fall to 2.9%, while the Eurozone experienced a drop from 2.9% to 2.4%. The primary factor behind these trends was the stabilization of energy prices and the easing of supply chain disruptions. However, potential trade tensions and tariffs introduced by the U.S. administration could reverse these gains and drive inflation higher in 2025.

Food prices saw moderate growth, though they remained significantly lower than their 2022 peak. The FAO Food Price Index increased by 6.7% year-on-year, with vegetable oil prices rising by 9.4% due to supply shortages. Meat and dairy prices also showed moderate gains, influenced by high global demand and production limitations.

Energy prices played a crucial role in keeping GCC inflation under control. Unlike the United States, where energy prices declined by 0.5%, GCC nations maintained artificially low energy costs through subsidies and price regulations, ensuring stability in inflation levels.

With global inflation slowing, central banks worldwide paused interest rate hikes, and some introduced rate cuts. The U.S. Federal Reserve implemented three rate cuts in 2024, bringing its key rate down to 4.25%-4.5%. The European Central Bank also cut rates four times, reducing the Deposit Facility Rate to 2.75% by the end of the year. Given that most GCC currencies are pegged to the U.S. dollar, regional central banks followed suit, with the UAE Central Bank cutting its base rate to 4.4% and Saudi Arabia’s Central Bank (SAMA) lowering its repo rate to 5%. However, Kuwait maintained its discount rate without making any reductions.

Country-specific inflation trends revealed variations across the GCC. In Kuwait, inflation fell to 2.5% in 2024, driven by a 5.0% increase in food and beverage prices and a 5.1% rise in clothing costs, while transportation prices dropped by 1.5%. In Saudi Arabia, inflation rose slightly to 1.9%, with the housing sector experiencing an 8.9% increase, largely due to a 10.6% rise in rental prices. The food and beverage sector saw a modest 0.8% increase, while personal goods and services rose by 2.2%.

Dubai’s inflation remained at 3.3%, with housing costs rising by 6.7%. The food and beverage sector increased by 2.4%, a slower rate than the previous year, while transportation costs declined by 2.2%. In Qatar, inflation saw only a marginal 0.2% increase, with food prices declining by 2.2% and housing and utility costs dropping by 4.2%. However, communication services experienced the highest price increase at 4.4%.

Bahrain maintained one of the lowest inflation rates in the GCC at 0.5%, with housing, water, and electricity prices falling by 9.5%, offsetting increases in other sectors. Oman recorded a slight inflation rise of 0.7%, mainly due to a 1.7% increase in food and beverage prices. Vegetable prices surged by 7.6%, while fish and seafood prices declined by 6.3%.

Looking ahead to 2025, inflation in the GCC is expected to remain moderate, supported by stable energy prices and government subsidies. However, rising housing costs in Dubai and Saudi Arabia could sustain inflationary pressures in these sectors. Trade tensions between the U.S. and major economies pose a potential risk, as tariffs on goods could drive prices higher. Nevertheless, with global inflation projected to decline further, GCC nations are expected to maintain their relatively low inflation environment through monetary policy coordination and continued government support.

The GCC region successfully managed inflation in 2024 through targeted policies, ensuring price stability despite fluctuations in housing and food prices. The overall economic outlook remains positive for 2025, with inflation levels expected to stay well below global averages.