Equity markets across the Gulf Cooperation Council (GCC) declined in August, reversing gains from the previous two months, as falling oil prices and sector-specific pressures weighed on investor sentiment, according to Kamco Invest’s latest GCC Markets Monthly Report.

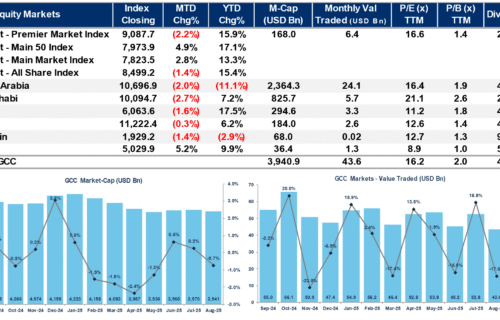

The MSCI GCC index dropped 2.3% during the month, erasing July’s recovery and reducing year-to-date gains to just 1.4%. The downturn was led by Abu Dhabi, where the FTSE ADX Index fell 2.7%, followed by Saudi Arabia’s Tadawul (-2.0%) and Dubai’s DFM (-1.6%). Kuwait’s All-Share Index slipped 1.4%, while Qatar and Bahrain recorded marginal declines. Oman was the only market to post a gain, advancing 5.2% .

The correction came despite positive trends in global equities, with the MSCI ACWI up 2.4% in August on the back of gains in the US, Europe, and emerging markets. However, GCC investors reacted to a 6.1% monthly drop in oil prices, driven by oversupply concerns and slower demand recovery.

At the sector level, performance was mixed. The GCC Materials index gained 4.3%, supported by Saudi heavyweights such as SABIC (+6.0%) and Advanced Petrochemicals (+4.0%). Pharma & Biotech and Diversified Financials followed with increases of 3.9% and 2.7%, respectively. In contrast, Insurance led the losers with a 7.2% drop, while Healthcare and Real Estate fell 3.9% and 2.7%, respectively. Banking stocks were also weaker, down 2.4% .

Saudi Arabia’s Tadawul recorded its sharpest year-to-date decline in the region at -11.1%, reflecting weaker earnings announcements, oil price pressures, and geopolitical uncertainties. Conversely, Dubai remained the strongest performer in 2025 with a 17.5% gain, underpinned by strength in real estate and consumer sectors earlier in the year.

Trading volumes were also lower across several markets. In Saudi Arabia, share trading volumes fell nearly one-third month-on-month, while Abu Dhabi’s traded value dropped 25.6%. Dubai and Bahrain also reported slower activity, whereas Oman saw trading values rise by nearly 13% .

The report underscores ongoing divergence within GCC markets: while Oman and Dubai benefit from localized growth drivers, Saudi Arabia and Abu Dhabi remain sensitive to oil price fluctuations and global risk sentiment.