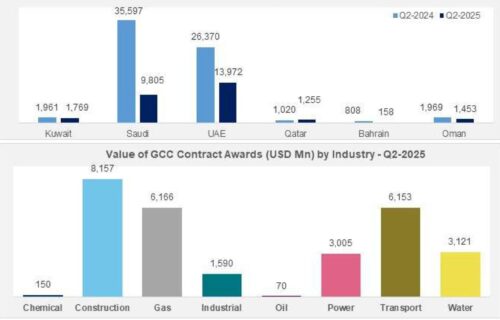

The total value of contracts granted in the Gulf Cooperation Council (GCC) declined sharply in the second quarter of 2025, falling 58% year-on-year to USD 28.4 billion, according to Kamco Invest. This marks the lowest quarterly total in 14 quarters, compared to USD 67.7 billion in Q2 2024. The drop was led by a significant contraction in Saudi Arabia and reduced activity in the UAE, which together shaped the region’s overall downturn.

In the first half of 2025, total GCC contracting activity decreased by 38.9% year-on-year to USD 86 billion, down from USD 140.7 billion in the same period last year. All GCC countries recorded a decline in Q2 2025, except Qatar, while only Kuwait posted year-on-year growth in the first half.

Most sectors also experienced lower activity, with seven out of eight main sectors seeing reduced levels of contracting. The construction sector saw a 60% drop to USD 8.2 billion, while the oil sector fell by 98.4% to USD 70 million. The chemical industry was the only sector to register an increase.

Country Highlights

Saudi Arabia:

Contracting activity dropped 72.5% in Q2 2025 to USD 9.8 billion. The construction sector fell nearly 60%, while the oil sector had no new projects granted. The transport and water sectors led what limited activity took place. Saudi Arabia’s total project pipeline stood at more than USD 1.98 trillion at the end of June, spanning various development phases.

UAE:

Despite a 47% decline to USD 14 billion, the UAE remained the region’s most active market for the quarter. The gas sector led with USD 5.3 billion in project allocations. Major contracts included a USD 400 million LNG supply deal between ADNOC Gas and Germany’s SEFE, and the USD 5 billion Rich Gas Development Scheme launch.

Kuwait:

Kuwait saw a Q2 decline of 9.8% to USD 1.8 billion but was the only GCC country to post growth over the first half, with contracts granted rising 39% to USD 3.3 billion. Key contributors included infrastructure development under Vision 2035. Notable projects included a USD 200 million contract with NESR for a new manufacturing facility.

Qatar:

Qatar’s project allocations increased 23% in Q2 to USD 1.3 billion, mainly due to transport and power sector activity. However, overall first-half contracting dropped 31% compared to the same period last year. Significant awards included a major gas infrastructure project under the North Field Production Sustainability initiative, granted to Larsen & Toubro.

Outlook

Despite a weak first half, Kamco Invest expects project activity in the GCC to rebound in the second half of 2025, with Saudi Arabia expected to lead the recovery. The upcoming pipeline across the region totals USD 1.73 trillion, with Saudi Arabia and the UAE comprising the largest shares. Projects in planning include Saudi Arabia’s proposed USD 80 billion CARE nuclear power reactor and other large-scale infrastructure and energy developments.