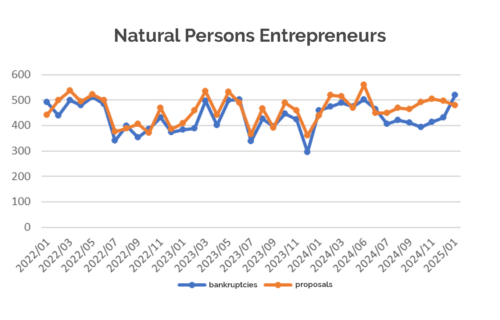

The number of bankruptcies among sole proprietors in the Czech Republic increased sharply in January, with 520 cases recorded, marking a 21% rise compared to December. Meanwhile, 480 new bankruptcy filings were submitted, a 3% decrease from the previous month. According to an analysis by CRIF – Czech Credit Bureau, the Moravian-Silesian Region continues to have the highest rate of bankruptcies relative to the number of active entrepreneurs.

January’s bankruptcy figures were 75 cases higher than the monthly average for 2024, signaling a significant increase in financial difficulties among business owners. Over the past 12 months, 5,398 bankruptcies were declared, reflecting a 7% increase compared to the previous year. In contrast, the number of new bankruptcy filings during the same period rose by 8%, reaching 5,870 cases.

The rise in bankruptcies follows a period of decline in previous years, but since mid-2024, the number of entrepreneurs has started to grow again. While credit activity has resumed, entrepreneurs’ savings remain three times higher than their debt, indicating cautious financial behavior.

Regional Disparities in Bankruptcy Rates

The highest number of bankruptcies in January was recorded in Prague and the Moravian-Silesian Region, both reporting 71 cases. In contrast, no bankruptcies were recorded in the Karlovy Vary Region. Year-on-year, bankruptcies increased most rapidly in the Olomouc and Central Bohemia regions, while the Karlovy Vary and Ústí regions—historically among the most vulnerable areas for entrepreneurs—saw a decline.

Over the past 12 months, the Moravian-Silesian Region had the highest number of bankruptcies per 10,000 active entrepreneurs at 85, followed by the Ústí Region (80) and Karlovy Vary Region (79). The lowest rates were recorded in Prague (35), Zlín Region, and Central Bohemia (42 each).

Sectors Most Affected by Bankruptcies

The construction sector was hit hardest in January, with 121 bankruptcies, followed by trade (105 cases) and manufacturing (55 cases). Over the past 12 months, the transport and storage sector recorded the highest bankruptcy rate at 73 bankruptcies per 10,000 businesses, followed by construction (50 cases) and accommodation and catering (36 cases). The lowest rates were observed in health and social care (2 cases), energy production and distribution (3 cases), and education (7 cases).

Year-on-year, the cultural and entertainment sector, along with transport, storage, and professional scientific activities, saw the fastest increases in bankruptcies.

Seasonal Trends in Bankruptcies

Historically, January has recorded the second-lowest share of bankruptcies, accounting for 8.3% of annual cases between 2013 and 2024. In contrast, May typically sees the highest number of bankruptcies, averaging 8.8% of annual cases.

The latest data reflects ongoing financial struggles for small business owners in the Czech Republic, with regional and sectoral variations indicating broader economic pressures in certain industries.

Source: CRIF