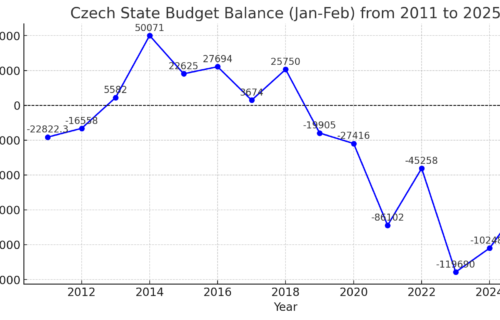

The Czech Republic’s state budget deficit increased to CZK 68.6 billion at the end of February, up from CZK 11.2 billion in January, according to data released by the Treasury Department. This marks the fourth-largest budget deficit since the country’s establishment. Finance Minister Zbyněk Stanjura (ODS) noted that despite the deficit, the year-on-year decline in the shortfall is a positive development, as the deficit in the first two months of last year reached CZK 102.5 billion.

State budget revenue amounted to CZK 296.5 billion at the end of February, an increase of 8.6% compared to the previous year. Meanwhile, budget expenditures declined by 2.8% year-on-year to CZK 365.1 billion. The finance minister explained that February is traditionally the weakest month of the year due to advance payments for education and the absence of revenue from quarterly tax advances. He emphasized that overall tax revenue is growing, reflecting wage increases and adjustments in tax allocation.

Raiffeisenbank analyst Martin Kron described the budget result as relatively positive but cautioned that it is too early to determine whether the full-year deficit target of CZK 241 billion will be met. He noted that upcoming months will be crucial in assessing the impact of the government’s fiscal consolidation package and the overall performance of the Czech economy. He also highlighted the long-term challenge of financing increased defense spending.

Komerční banka analyst Jaromír Gec indicated that if the full-year budget deficit aligns with government projections, the public deficit would stand at approximately 2.3% of GDP, an improvement from last year’s 2.7% and a figure significantly better than the EU average.

Tax revenues, including social insurance contributions, were the primary drivers of budget revenue growth in February. The collection of consumption and energy taxes increased, bringing in CZK 28 billion, a 14.9% year-on-year rise, partly due to stockpiling of tobacco products ahead of an excise tax increase. Personal income tax revenue rose by 10.6% to CZK 29.6 billion, largely due to wage growth. Value-added tax (VAT) remained the largest contributor to state revenue, generating CZK 66.1 billion, an increase of 8.7% year-on-year.

Total state expenditure fell by 2.8%, largely due to a reduction in energy subsidies, which cost the state CZK 12.5 billion less than in the first two months of 2024. Social benefits remained the largest expenditure category, amounting to CZK 155.3 billion, a 1.7% increase from the previous year, with pension payments accounting for CZK 121.2 billion.

Capital expenditures decreased by 16.7% year-on-year to CZK 17.4 billion, which the Ministry of Finance attributed to irregular financing of EU and Czech joint programs. The ministry also pointed out that capital expenditures tend to be low in the early months of the year, with investment activity typically increasing in the latter half.

For 2025, the state budget is set with revenues of CZK 2.086 trillion and expenditures of CZK 2.327 trillion, resulting in a planned deficit of CZK 241 billion. In 2024, the budget ended with a deficit of CZK 271.4 billion, the lowest since the start of the COVID-19 pandemic but still the fifth-largest in Czech history.

Source: CTK