Companies established in the early 1990s have proven to be the most economically stable in the Czech market, particularly those with an annual turnover exceeding CZK 30 million, according to an analysis by CRIF – Czech Credit Bureau. Recognizing business stability as a key factor for economic success, CRIF has introduced two new certification programs, TOP Stable Company and Stable Company, aimed at distinguishing reliable businesses from those with weaker financial standings.

The certifications are based on the CRIBIS Index, which evaluates companies using nine financial ratios derived from their two most recent financial statements. Additionally, non-financial factors such as foreclosures, unpaid debts, VAT non-compliance, and insolvency proceedings influence the final rating. “Our assessment helps businesses minimize risk when selecting partners without the need for exhaustive registry checks. This certification serves as an assurance that a company is financially stable and free from outstanding liabilities,” explained Petr Kučera, Executive Director of CRIF – Czech Credit Bureau. To qualify, businesses must also have no records in the Central Register of Executions or AML sanction lists.

The CRIBIS Index assigns 10 stability grades, with companies rated a1 to b2 receiving the TOP Stable Company certification, indicating exceptional financial strength. Of the 45,555 companies with annual turnovers exceeding CZK 30 million, 25% meet the highest stability standards.

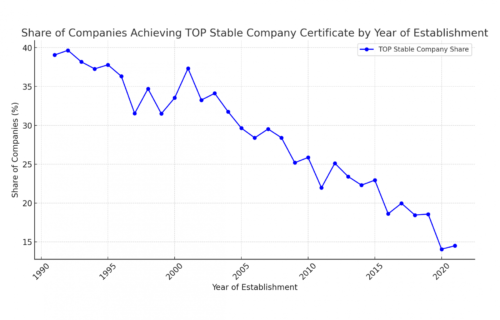

Data reveals that companies founded between 1991 and 1995 show the greatest financial resilience, with 40% of businesses from this period receiving the top certification. Specifically, two-fifths of firms founded in 1992 meet the highest criteria, followed by 1991 (39%) and 1993 (38%). “The longevity of these companies demonstrates their strong competitive position and ability to maintain market stability over time,” noted Pavel Finger, a member of the CRIF Board of Directors.

Conversely, companies founded after 2004 exhibit lower financial stability, with the percentage of firms meeting top criteria declining from 32% in 2004 to just 15% in 2021. Finger attributes this to increased market competition and regulatory changes following the Czech Republic’s EU accession. Businesses established in the last decade show the lowest stability levels—only 23% of companies founded in 2015 meet the strictest requirements, while for 2020-founded businesses, the figure drops to just 14%.

Regionally, Vysočina emerges as the top-performing region, with 35% of its companies receiving the highest ratings. Close behind are Ústí nad Labem and Hradec Králové, both at 34%. At the other end, Prague has the lowest percentage of stable companies (24%), likely due to higher market competition and dynamic economic conditions. However, Prague remains the dominant business hub, with 17,000 firms generating over CZK 30 million in turnover, representing 36% of all assessed companies.

Sector-wise, the mining and quarrying industry has the highest proportion of financially stable companies, with 42% meeting the top criteria. This sector also boasts one of the lowest bankruptcy rates and a strong asset-to-liability ratio, with loans accounting for just 18% of company deposits.

Conversely, the real estate management sector ranks lowest, with only 15% of firms qualifying for top stability rankings. Many real estate businesses operate with high debt levels, as borrowed funds exceed deposits by 79%, making them more vulnerable to financial instability.

Source: CRIF – Czech Credit Bureau