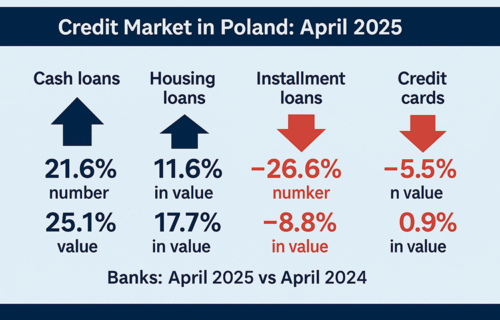

In April 2025, the Polish credit market showed mixed trends across various loan segments, according to data released by the Credit Information Bureau (BIK). While cash and housing loans continued to expand, installment loans and credit card activity recorded declines.

Growth in Cash and Housing Loans

Compared to April 2024, the number of cash loans granted rose by 21.6%, and their total value increased by 25.1%. The average cash loan reached PLN 26,864, up 2.9% year-on-year. Analysts attribute this growth to high-value loan consolidation, where borrowers combine multiple liabilities into a single loan, often with extended terms or lower interest rates, enhancing affordability.

The housing loan segment also showed recovery, with the number of loans increasing by 11.6% compared to April 2024, and by 3.7% from the previous month. In value terms, housing loans rose 17.7% year-on-year and 5.7% month-on-month. The total value reached PLN 8.13 billion, a level not seen since 2021, excluding the months influenced by the government’s “Safe Loan 2%” program. The average housing loan amount was PLN 436,870, representing a 5.5% increase over the year.

Sharp Decline in Installment Loans

Installment loans saw a significant decline. The number of such loans dropped by 26.6%, and their value fell by 8.8% compared to April 2024. The average installment loan, however, rose to PLN 2,275, an increase of 24.3% year-on-year. According to BIK Chief Analyst Prof. Waldemar Rogowski, the drop in volume is partly due to a reduction in low-value transactions linked to buy-now-pay-later (BNPL) conversions from the non-banking to banking sector, a process that has now slowed. While high-value loans for major purchases helped offset the decline, the outlook for this segment remains uncertain amid economic and political uncertainty.

Credit Card Activity Dips

In April 2025, the number of credit cards issued fell by 5.5%, although the value of credit card limits increased slightly by 0.9%. Over the January–April period, the number of credit cards issued declined by 6.2% year-on-year, while the value rose by 3.8%.

January–April 2025 Summary

Over the first four months of 2025, cash loans remained the only category showing growth in both volume and value. The number of cash loans rose 25.1%, and their value surged by 35.6%. In contrast, installment loans declined 28.6% in volume and 11.5% in value. Housing loans fell 17.3% in volume and 14.9% in value. Credit card issuance also declined.

Credit Quality Improves

The BIK credit quality indices for all four credit products showed improvement year-on-year and month-on-month. According to Prof. Rogowski, credit quality remains at a safe level and continues to improve. He cautioned, however, that while classic credit risk remains contained, legal risks related to both housing and consumer loans pose a growing concern for the banking sector.

Overall, the April 2025 credit market data reflects strong consumer demand for cash and housing loans, subdued activity in installment and credit card lending, and continued improvements in credit quality. The market’s future direction may hinge on further interest rate changes and the broader economic climate.