The Gulf Cooperation Council (GCC) fixed income market is navigating a complex landscape in 2025, shaped by global monetary policy shifts, geopolitical tensions, and evolving investor sentiment, according to the latest GCC Fixed Income Market Update from Kamco Invest.

Global Volatility Shapes Outlook

Global debt markets hit record highs in the first half of 2025, with issuances reaching $6.4 trillion despite an 8% quarter-on-quarter drop in Q2. High-grade issuances dominated, while high-yield activity remained flat. Notably, green bond issuances fell to a three-year low of $267.7 billion in the first half.

In the U.S., treasury yields have fluctuated, with the 10-year yield declining from May highs of 4.6% to around 4.3% by July. The Federal Reserve remains cautious on rate cuts, with decisions hinging on the inflationary impact of new tariffs. Meanwhile, Europe has moved in the opposite direction, with the European Central Bank cutting rates four times this year to support a slowing economy.

GCC Market Adapts to Global Dynamics

GCC central banks largely mirror U.S. monetary policy due to currency pegs, though Kuwait, whose dinar is pegged to a basket of currencies, has charted a more conservative path. While other GCC nations cut rates by 100 basis points in 2024, Kuwait opted for a modest 25-basis-point cut.

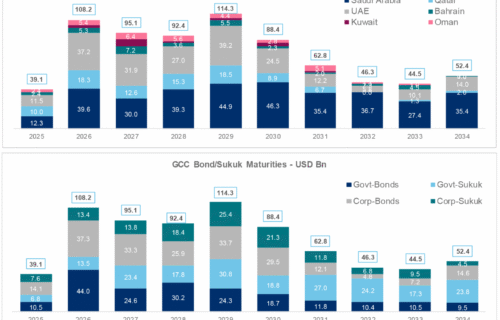

Economic prospects in the GCC remain supported by resilient non-oil sectors and stable oil prices around $70 per barrel. However, the region faces significant debt maturities. Sovereign and corporate maturities across the GCC are projected to total nearly $449 billion between 2025 and 2029, with Saudi Arabia leading at $166 billion.

Issuances Decline, But Outlook Remains Solid

Primary market issuances in the GCC totaled $100.3 billion in H1-2025, a 22% drop from the same period in 2024. Government issuances halved to $36.6 billion, while corporate issuances rose to $63.7 billion, partially offsetting the decline. Sukuk issuance saw a sharper contraction, falling nearly one-third to $39.4 billion.

Country-wise, the UAE posted slight growth in issuances, while Saudi Arabia, Qatar, and Oman witnessed significant declines. Saudi issuers remained dominant, accounting for half of the region’s issuance despite a steep year-on-year decrease.

Green instruments maintained momentum in the region, with $8.7 billion issued in H1-2025. Saudi Arabia led the segment with $5.6 billion in green debt, underscoring the region’s gradual pivot toward sustainable financing.

Rate Cuts Expected to Shape Second Half

Looking ahead, Kamco Invest forecasts that GCC central banks will likely mirror any U.S. Federal Reserve rate cuts later this year. Issuance volumes are anticipated to pick up in the second half, as issuers seek to lock in lower rates amid growing expectations of monetary easing.

Moreover, Kuwait has announced plans to issue $6 billion in bonds on international markets, which could further bolster regional issuance figures.

Despite near-term headwinds from global economic shifts and geopolitical tensions, the GCC fixed income market appears poised to maintain stability, underpinned by robust sovereign credit profiles and steady economic fundamentals.