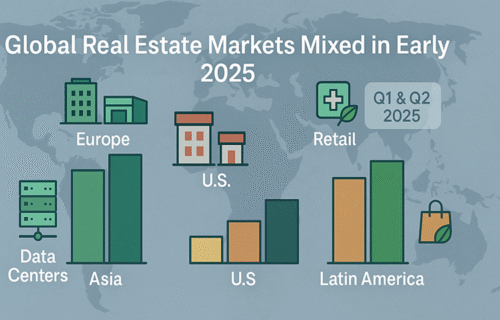

Global real estate markets delivered mixed performance through the first half of 2025, reflecting regional economic differences and shifting investor sentiment, according to the latest scorecards published by S&P Dow Jones Indices covering the first and second quarters of the year.

U.S. Real Estate Performance Softens in Q2

The U.S. real estate sector lagged behind global counterparts in the second quarter of 2025. The Dow Jones U.S. Real Estate Index slipped 0.4% in Q2 after modest gains earlier in the year. Despite the quarterly decline, the index posted a 10.3% gain over the past 12 months. Data Centers emerged as the strongest U.S. property segment in Q2, rising 7.0%, followed by Hotels with a 3.5% increase. However, Factory Outlets and Apartments declined sharply, dropping 8.7% and 7.0%, respectively .

Over the first quarter, the U.S. market showed modest positive returns. The Dow Jones U.S. Real Estate Index rose 3.5% in Q1, driven by strength in sectors like Health Care (+16.2%) and Industrial (+6.3%), while Data Centers and Hotels experienced negative returns .

Europe and Asia Lead Global Gains

Outside the U.S., real estate markets posted notable gains, especially in Europe and Asia. The Dow Jones Europe Select RESI Index surged 18.6% in Q2, while the Asia/Pacific Select RESI Index climbed 10.4%. Strong performance was observed in European offices and diversified sectors, while Asian gains were more broadly distributed .

In Q1, non-U.S. markets were more subdued, with indices such as the Dow Jones Europe Select RESI up only 5.1% and the Asia/Pacific Select RESI rising 7.3%. Still, these regions fared better than U.S. counterparts during the early part of the year .

Emerging Markets Show Strength

Emerging markets saw substantial advances in Q2. The S&P Latin America Property Index posted a significant gain of 19.3% for the quarter and an even higher 35.6% year-to-date return. The S&P Emerging REIT Index rose 12.5% in Q2, driven by gains in Latin America and parts of Asia. Key sectors like Retail and Office Space in emerging markets also delivered double-digit growth .

Earlier in Q1, the emerging markets were less consistent. The S&P Emerging Property Index declined 1.7%, reflecting weakness in Asia-Pacific, although Latin America began to show signs of recovery .

Sustainability and ESG Trends

Sustainable real estate investments continued to gain traction globally. ESG-focused indices, such as the Dow Jones Global Select ESG RESI, delivered positive results in both quarters. In Q2, the ESG RESI rose 2.5%, following a similar 2.4% gain in Q1. The data highlights investors’ sustained interest in ESG-oriented real estate strategies despite broader market volatility  .

Sector Highlights

• Data Centers showed divergent performance: strong in Q2 (+7.0% in the U.S. and +14.4% globally) after steep declines in Q1.

• Hotels rebounded slightly in Q2 (+3.5% in the U.S.) after negative returns in Q1.

• Industrial real estate faced headwinds in both periods, posting negative quarterly returns.

• Health Care remained a relatively stable sector, maintaining positive performance, particularly in Q1 with gains above 14% in some indices  .

Outlook

The scorecards indicate a real estate market that remains sensitive to interest rate movements, economic growth prospects, and investor appetite for both traditional and sustainable assets. While U.S. real estate showed mixed signals, international and emerging markets offered stronger returns in Q2, underscoring the global diversity of real estate investment performance so far in 2025.

Source: S&P Dow Jones Indices