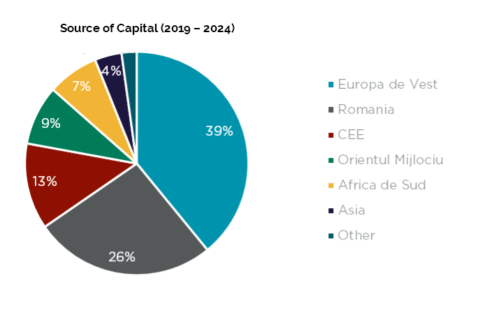

Western European investors, particularly from Austria, the Netherlands, Belgium, and the United Kingdom, have been the most active buyers of real estate assets in Romania over the past five years, investing a total of €1.75 billion. This represents 39% of the total transaction volume of €4.5 billion recorded between 2019 and 2024, according to real estate consultancy Cushman & Wakefield Echinox.

Romanian investors followed with acquisitions worth nearly €1.2 billion, accounting for 26% of the market. Investors from Central and Eastern Europe purchased real estate assets valued at €560 million (13% market share), while Middle Eastern investors contributed €388 million. South African investors saw a decline in activity, holding only a 7% share of the market.

Despite market volatility and global economic challenges, the Romanian real estate sector has continued to attract new international investors. Among the newcomers are M Core (UK), Supernova (Austria), Adventum Group (Hungary), Fortress (South Africa), Oresa Industra (Sweden), BT Property (Romania), Vectr Holdings (India), Vincit Union (Latvia), W&E Assets (USA), and AYA Properties (Belgium).

Existing players in the market made significant acquisitions, with Pavăl Holding, CTP, and AFI Europe leading the way. Pavăl Holding and AFI Europe expanded their office portfolios, while CTP focused on industrial and logistics parks. These transactions marked the exit of Austrian group CA Immo from Romania, NEPI Rockcastle’s withdrawal from the office sector, and Globalworth’s departure from the industrial segment.

According to Cristi Moga, Head of Capital Markets at Cushman & Wakefield Echinox, the Romanian real estate market has attracted capital from over 20 countries across four continents. European investors, including Romanian ones, accounted for approximately 80% of the total transaction volume. While Western European investors continue to demonstrate strong acquisition interest, growing activity from Central and Eastern European investors is also being observed.

Between 2020 and 2024, 159 real estate transactions were recorded in Romania, with an average transaction value exceeding €28 million. Office buildings were the most frequently traded assets, accounting for over €2.2 billion, nearly 50% of the total volume. Retail projects represented 24%, while industrial properties accounted for 19%.

Approximately 60% of the investment volume was directed toward Bucharest, while more than 25% involved portfolio acquisitions of properties in multiple Romanian cities.