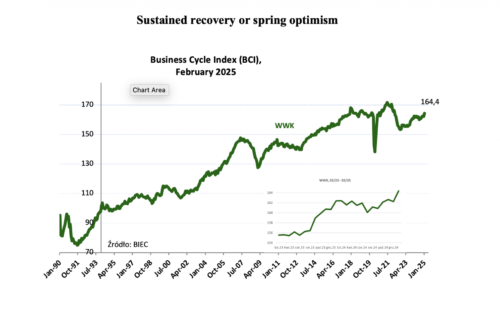

The Business Cycle Index (BCI), which provides an early indication of future economic trends, increased by more than two points in February 2025 compared to January. This marks the first notable improvement in the index since autumn 2023, raising hopes for a potential economic recovery. However, much of this growth is driven by improved sentiment among business leaders rather than changes in statistical economic data. Despite this, business optimism is often an early indicator of broader economic improvements that may not yet be reflected in official figures.

A key factor behind the index’s rise is the strong performance of the Warsaw Stock Exchange. The WIG index reached another peak, though in real terms it has only returned to levels seen in March 2024. Analysts suggest that while recent stock market momentum has contributed to positive sentiment, the potential for further rapid growth may be limited in the short term.

The manufacturing sector has also shown signs of stabilization. While the number of companies reporting a decline in new orders still exceeds those reporting an increase, the pace of decline has slowed, particularly in export markets. Industries such as electronics, chemicals, and paper have seen a rise in foreign orders, while the clothing and leather sectors continue to struggle.

The financial outlook for businesses has stopped deteriorating, though there are few signs of a tangible improvement. Companies continue to face weak demand, high labor costs, and elevated energy prices, with 60% of surveyed businesses citing energy costs as a major challenge—the highest level recorded in the past five years. In response, many firms have implemented cost-cutting measures, including reducing excess inventories and optimizing staffing levels. The decline in stockpiled finished goods has allowed companies to maintain production levels and prepare for potential increases in demand.

In the financial sector, the M3 money supply has decreased, a typical seasonal trend at the start of the calendar year. Consumer credit, including mortgage loans, remains weak, while household deposits continue to grow, reflecting cautious spending behavior.

While the latest data suggests cautious optimism, the extent to which improved sentiment will translate into sustained economic growth remains uncertain.

Source: BIEC