NEPI Rockcastle continued to set new records in 2024. Distributable earnings (both in absolute terms and per share) and net operating income were the highest in the Group’s history. The 11.8% increase in distributable earnings (5.6% on a per share basis) was in line with the upward revision to guidance communicated in August 2024. Portfolio value at year-end reached almost €8 billion, consolidating NEPI Rockcastle’s position as one of the largest and fastest growing retail property landlords in Europe.

Rüdiger Dany, CEO, NEPI Rockcastle said “Our robust financial performance reflects the operational excellence of our portfolio and the strength of consumer demand in Central and Eastern European markets. The 13.2% increase in NOI last year was fundamentally driven by higher tenant sales, allowing us to raise base rents and collect more turnover rent (up by 15% versus 2023). The occupancy cost ratio (“OCR”) has remained at the same sustainable level since 2022, which demonstrates our success in working collaboratively with our retailer partners to create and share value together. We strive through active asset management to constantly improve our properties and make them even more attractive for both retail brands and consumers. As a result, we managed to bring down vacancy to 1.7% across the portfolio — a remarkable achievement. At the same time, we also look to grow through financially accretive and sustainable investments. From this point of view, 2024 was a landmark year for us.”

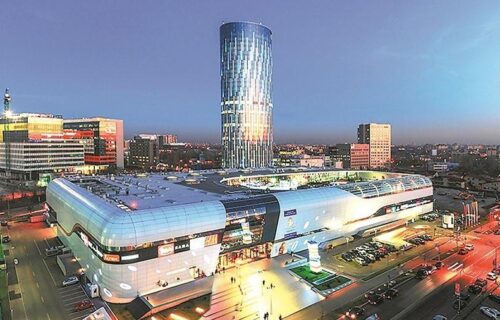

In 2024, NEPI Rockcastle acquired two of the most attractive retail properties in Poland, Magnolia Park in Wroclaw and Silesia City Center in Katowice, which will significantly contribute to growth in coming years. The Company is also firmly on track to deliver on its ambitious development pipeline.

To finance the two large acquisitions of 2024, NEPI Rockcastle raised €800 million from capital markets towards the end of last year. The strong confidence that investors and financers have in NEPI Rockcastle’s investment strategy was evidenced by the highly competitive terms achieved for both the debt and equity raises. To maintain the Group’s loan to value (“LTV”) ratio below the target 35% threshold, the Company paired the €500 million green bond issue with a €300 million equity raise, the first such endeavour since 2017. Management intends to build on the strong relationships developed with capital providers and continue accessing capital markets to fund future opportunities.

NEPI Rockcastle ended the year with an LTV of 32.1% and €1.1 billion in liquidity (including unused credit facilities) even after the major investments made in 2024, reinforcing its commitment to balance sheet strength as a key priority for the Group. NEPI Rockcastle strongly believes in the positive economic prospects for its CEE markets, but the macroeconomic environment remains unpredictable and challenging, and the Group has to be prepared for a range of possible future scenarios.

In 2024, NEPI Rockcastle reaffirmed its commitment to achieve its ambitious sustainability objectives. Key initiatives include reducing emissions, transitioning to renewable energy, achieving zero avoidable waste, and conserving natural resources. Additional efforts focus on ESG certifying of the asset portfolio, supporting tenant-led sustainability initiatives, fostering local employment, and enhancing visitor satisfaction.

The Company completed the installation of photovoltaic panels in Romania and Lithuania, achieving a total installed capacity of 38 MW across 28 properties (30 installations). The second phase of this renewable energy programme will add another 15 MW in 23 of NEPI Rockcastle’s properties outside Romania (individual projects are under various stages of design, permitting and tendering). The third phase aims to develop greenfield photovoltaic plants with a much larger capacity. In Q4 2024, the Group acquired two project companies holding land rights, building permits and grid connection permits for photovoltaic projects with a cumulated capacity of 159 MW. These investments, estimated at €110 million in total, are expected to generate a return on capital roughly relativeto retail developments. Moreover, they will significantly expand the Group’s green energy generating capacity and the proportion of its tenants’ electricity consumption, enhancing the revenues from green energy production.

Rüdiger Dany concluded: “NEPI Rockcastle’s impressive financial performance in 2024 and the significant portfolio expansion have established solid foundations for the future. In 2025 we will continue looking for opportunities to grow our business that make strategic sense and deliver optimal investment returns.”