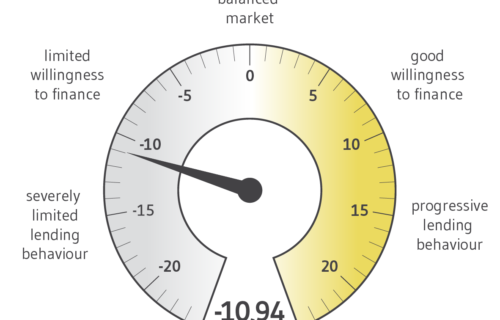

The sentiment among commercial real estate lenders declined slightly at the beginning of the year. The BF.Quartalsbarometer fell from -9.89 points to -10.94 points in Q1 2025, marking a drop of 1.05 points and breaking a five-quarter upward trend. Previously, the index had reached its lowest point in Q3 2023 at -20.22, while its highest score of +8.11 was recorded in Q1 2015.

Fabio Carrozza, Managing Director of BF.real estate finance GmbH, noted that the decline should not be overstated. While lenders remain cautious, there is continued openness toward financing volumes of up to 20 million euros, with a preference for inventory financing over property development financing. He pointed out that the moderately positive trend observed since the ExpoReal trade fair has continued into early 2025, despite the index still being in negative territory at -10.94 points.

Professor Dr. Steffen Sebastian of the International Real Estate Business School (IREBS) at the University of Regensburg attributed the decline in sentiment to economic uncertainty in Germany, the challenges of forming a new government, and geopolitical risks stemming from U.S. foreign policy. Additionally, concerns over inflation and potential interest rate hikes continue to affect lender confidence.

A key factor influencing the index score is the assessment of financing terms. The proportion of respondents expecting tighter financing conditions increased to 45%, a rise of 6.1 percentage points. At the same time, sentiment regarding new lending became more cautious, with only 32.5% of respondents anticipating stable or growing lending volumes, a decline of 6.4 percentage points. Meanwhile, 55% of respondents reported stagnation in new lending, an increase of 13.3 percentage points.

The composition of lending volumes has also shifted toward smaller transactions. More than half (51.3%) of survey participants reported average lending volumes below 10 million euros, up by 11.3 percentage points. In contrast, the share of respondents reporting average lending volumes between 10 and 50 million euros fell to 28.2%, a decline of 14.7 percentage points.

Margins have softened slightly from the borrower’s perspective. In inventory financing, margins decreased from 239.5 basis points in Q4 2024 to 223.7 basis points, a decline of 15.8 basis points. Development financing margins also saw a slight reduction, dropping by 6 basis points from 337 to 331 basis points. Carrozza highlighted that borrowers who have remained active despite the prolonged real estate downturn tend to be financially stable and are benefiting from improved loan conditions.