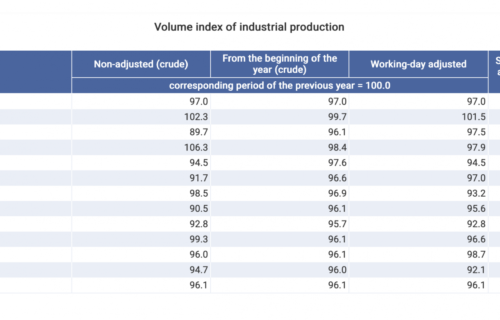

Industrial production in January 2025 fell by 3.9% compared to the same month in the previous year. The working-day adjusted index showed no variation from the unadjusted figures. However, seasonally and working-day adjusted data indicated a 0.8% increase in output compared to December 2024, suggesting a slight month-on-month improvement despite the annual decline.

A decrease in production volume was observed across most manufacturing subsections. Among the largest industrial segments, declines were recorded in the manufacture of transport equipment, electrical equipment, and food products, including beverages and tobacco. However, growth was noted in the production of computer, electronic, and optical products, providing some balance within the sector.

Despite the annual contraction, the industrial sector registered a modest recovery compared to the previous month, with adjusted indices reflecting a 0.8% rise in output. Meanwhile, the retail sector presented a contrasting picture, with sales volumes demonstrating significant growth both on an annual and monthly basis.

Retail trade in January 2025 saw a 4.7% increase compared to the same period in 2024, based on both raw and calendar-adjusted data. Sales expanded across multiple categories, with a 4.7% rise in specialized and non-specialized food shops, a 5.6% increase in non-food retailing, and a 1.9% uptick in automotive fuel retailing. When measured against the previous month, seasonally and calendar-adjusted data showed a 2.2% increase in retail sales, signaling continued consumer demand.

Food retailing, which accounts for a substantial portion of total retail trade, grew by 4.7%. Non-specialized food and beverage stores, making up 76% of the sector, saw a 5.1% rise in sales, while specialized food, beverage, and tobacco stores recorded a 3.2% increase.

Non-food retailing also experienced strong growth, with total sales volumes rising by 5.6%. The most notable increases were observed in pharmaceutical, medical goods, and cosmetics shops, where sales climbed by 9.7%. Furniture and electrical goods stores recorded a 7.8% increase, while non-specialized shops dealing in manufactured goods saw a 6.7% rise. Sales in textiles, clothing, and footwear stores increased by 4.7%, second-hand goods shops by 2.9%, and books, computer equipment, and other specialized stores by 0.3%.

E-commerce and mail-order sales, which represent 8.8% of total retail trade, expanded by 3.9%, reflecting steady consumer engagement in online shopping. The volume of sales at automotive fuel stations also rose, increasing by 1.9%.

Sales in motor vehicles and parts, which are not included in retail trade data, surged by 19% in January, highlighting a robust demand for automotive products.

In total, domestic retail sales for January 2025 amounted to HUF 1,477 billion at current prices. Specialized and non-specialized food shops accounted for 49% of total national retail turnover, while non-food retail trade contributed 35% and automotive fuel stations represented 16%.

While industrial production faced challenges at the start of the year, the steady expansion in retail sales suggests resilient consumer activity, potentially supporting broader economic stability in the coming months.

Source: Hungarian Central Statistical Office