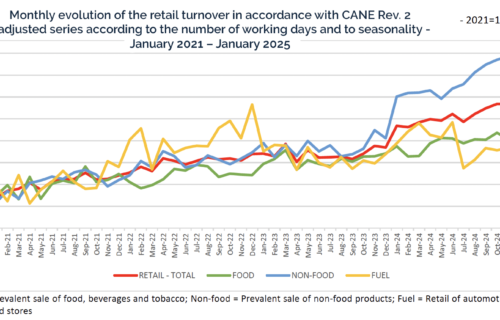

The retail sector in January 2025 experienced notable fluctuations in turnover, with significant month-on-month declines yet year-on-year growth across key categories. Data from the latest statistical report highlights contrasting trends, where short-term seasonal effects caused sharp decreases in retail sales compared to December 2024, while long-term trends indicated a steady increase from January 2024.

Retail turnover volume, excluding trade in motor vehicles and motorcycles, declined by 19.4% as a gross series from December 2024. However, after adjusting for the number of working days and seasonal variations, the decline was largely mitigated, with a marginal increase of 0.1% on a monthly basis. The drop was primarily driven by lower sales in food, beverages, and tobacco, which fell by 21.3%, while non-food products registered a decline of 20.5%. The retail of automotive fuel in specialized stores also recorded a decrease, though at a lower rate of 12.0%.

On a year-over-year basis, the retail sector presented a more optimistic picture. Compared to January 2024, the total retail turnover volume increased by 4.1% in gross series and by 3.2% in seasonally adjusted terms. This growth was largely driven by a strong performance in non-food retail, which recorded a 7.0% increase. The automotive fuel segment also contributed positively, with a rise of 7.3% in gross series and 1.2% in adjusted terms. Conversely, food, beverage, and tobacco sales declined by 0.9% in gross figures and showed a marginal decrease of 0.2% in seasonally adjusted data.

Breaking down the sector further, food, beverage, and tobacco sales, despite a steep month-on-month drop of 21.3%, showed near stability over the year, reflecting a minor decline in demand. Non-food product sales experienced a sharp monthly decrease but exhibited strong growth over the longer term, with a 5.8% increase in adjusted figures from January 2024. Meanwhile, automotive fuel sales, despite a short-term contraction, maintained resilience in annual performance, growing by 7.3% in gross terms and 1.2% in seasonally adjusted figures.

The contrasting trends in retail performance reflect the typical seasonal effects observed in January, following a peak in consumer spending during the holiday season in December. The sharp month-on-month decline is consistent with historical patterns, where post-holiday spending tightens across retail categories. However, the year-on-year growth suggests a steady expansion in consumer activity, particularly in non-food and fuel sales, which continue to drive overall retail sector performance.

The report also provides insight into the methodological framework used to calculate turnover figures. The retail turnover indices are based on Laspeyres-type indices, which adjust for price fluctuations and maintain comparability over time. The turnover volume is derived by aggregating invoiced revenues from sales while excluding excise duties, subsidies, and non-retail transactions such as land and fixed asset sales.

Looking ahead, analysts will closely monitor whether the retail sector can sustain its year-on-year growth amid economic uncertainties. While the beginning of the year has seen a typical seasonal decline in turnover, consumer demand for non-food products and fuel has shown resilience. If this trend continues, it may indicate stable economic conditions that support further growth in retail trade.

The next retail turnover report is scheduled for release on April 7, 2025, and will provide further insights into consumer spending trends and market conditions in the coming months. For more comparative data across European Union member states, additional reports from Eurostat will complement the national statistics.