According to REALOGIS Unternehmensgruppe, take-up in Hamburg’s owner-occupier and leasing market for logistics and industrial properties reached 335,000 sqm in 2025. This represents an increase of 22% compared with 275,000 sqm recorded in 2024, although the result remains 17% below the five-year average of 406,000 sqm.

The five largest transactions were concluded by Körber Technologies, Mickeleit, Scan Global Logistics Group, Garpa Garten & Park Einrichtungen GmbH and Heinrich Dehn. Together, these deals accounted for around 32% of total take-up during the year.

Commenting on the figures, Stefan Imken, Managing Director of REALOGIS Immobilien Hamburg GmbH, noted that the rise in take-up should be viewed as an indication of stabilisation rather than a return to peak market conditions. He added that a gradual recovery is expected in 2026, supported by steady to improving demand from logistics and industrial occupiers and largely stable rental growth.

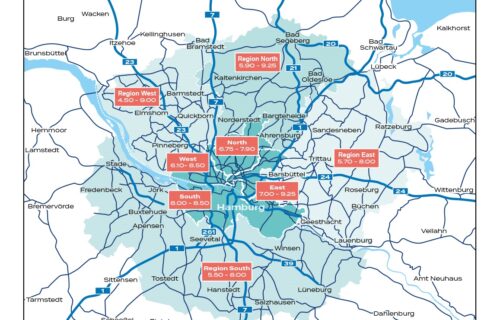

Rental levels in Hamburg remained broadly stable in 2025. Prime rent stood at €8.30 per sqm at year-end, slightly above the €8.25 per sqm recorded a year earlier. After peaking at €8.40 per sqm in mid-2025, prime rents eased modestly in the second half of the year. Average rents increased to €6.40 per sqm at the end of 2025, compared with €6.25 per sqm in 2024, having reached €6.50 per sqm in mid-year.

Market activity continued to focus mainly on existing buildings. A total of 224,300 sqm was leased in existing stock, accounting for 67% of take-up, compared with 84% in the previous year. New-build space accounted for 110,700 sqm, or 33% of total take-up, with the vast majority of this volume attributable to developments on brownfield sites. Transactions in new buildings on former brownfield land reached 109,200 sqm, while greenfield developments played only a marginal role, accounting for just 1,500 sqm.

Leasing activity again dominated the market. Tenants were responsible for 274,700 sqm, representing 82% of total take-up, while owner-occupiers accounted for the remaining 60,300 sqm. By building type, big-box logistics space led the market with 175,000 sqm, followed by other standalone properties and business parks.

From a regional perspective, Hamburg South emerged as the most active submarket in 2025, recording 141,400 sqm of take-up and a 42% market share. This marked a significant rebound compared with 2024, when the area had seen limited activity. Hamburg East followed closely with 131,900 sqm, while the West and North recorded considerably lower volumes.

By occupier sector, logistics and distribution companies clearly dominated demand, accounting for 209,900 sqm, or 63% of total take-up. Manufacturing occupiers accounted for 52,000 sqm, while retail and wholesale users leased 44,700 sqm. Within the retail and wholesale segment, demand was evenly split between e-commerce and traditional retail operators.

Demand was strongest for large units above 10,001 sqm, which together accounted for 131,000 sqm, followed by transactions in the 5,001 to 10,000 sqm range. Smaller units below 1,000 sqm represented only a small share of overall activity, continuing a trend toward larger space requirements among occupiers.